Red, Blue & Green – Presidential Elections and Your Portfolio

With the US Presidential election two short weeks away, we thought it would be good to look at historical evidence on how the equity market has reacted over the last century to political leadership changes. As the following research and data suggest, the political party in power matters less in the long-run versus the attention-grabbing headline in the short-term.

The intent of this communication is not a prognosticate who will win the election but to separate the vitriol political environment created by the press, and especially social media, and advance the conversation to what research reveals for the long-term. I think it is fair to expect we will see increased volatility up and through the election, a second wave of COVID notwithstanding, in what will likely turn into election week rather than election night. The market does not like is uncertainty, and it is reasonable to expect increased uncertainty with this election.

But is this true? Recall back to the 2000 election and “hanging chads?” Most of us can remember the images of Florida election officials hand-counting votes with magnifying glasses with the fight ultimately decided by the Supreme Court! As humans, our built-in cognitive biases overemphasize more recent events than those in the near or distant past. Making important decisions fueled entirely by emotion usually leads to unintended consequences and potentially a poor outcome – and investing is no different.

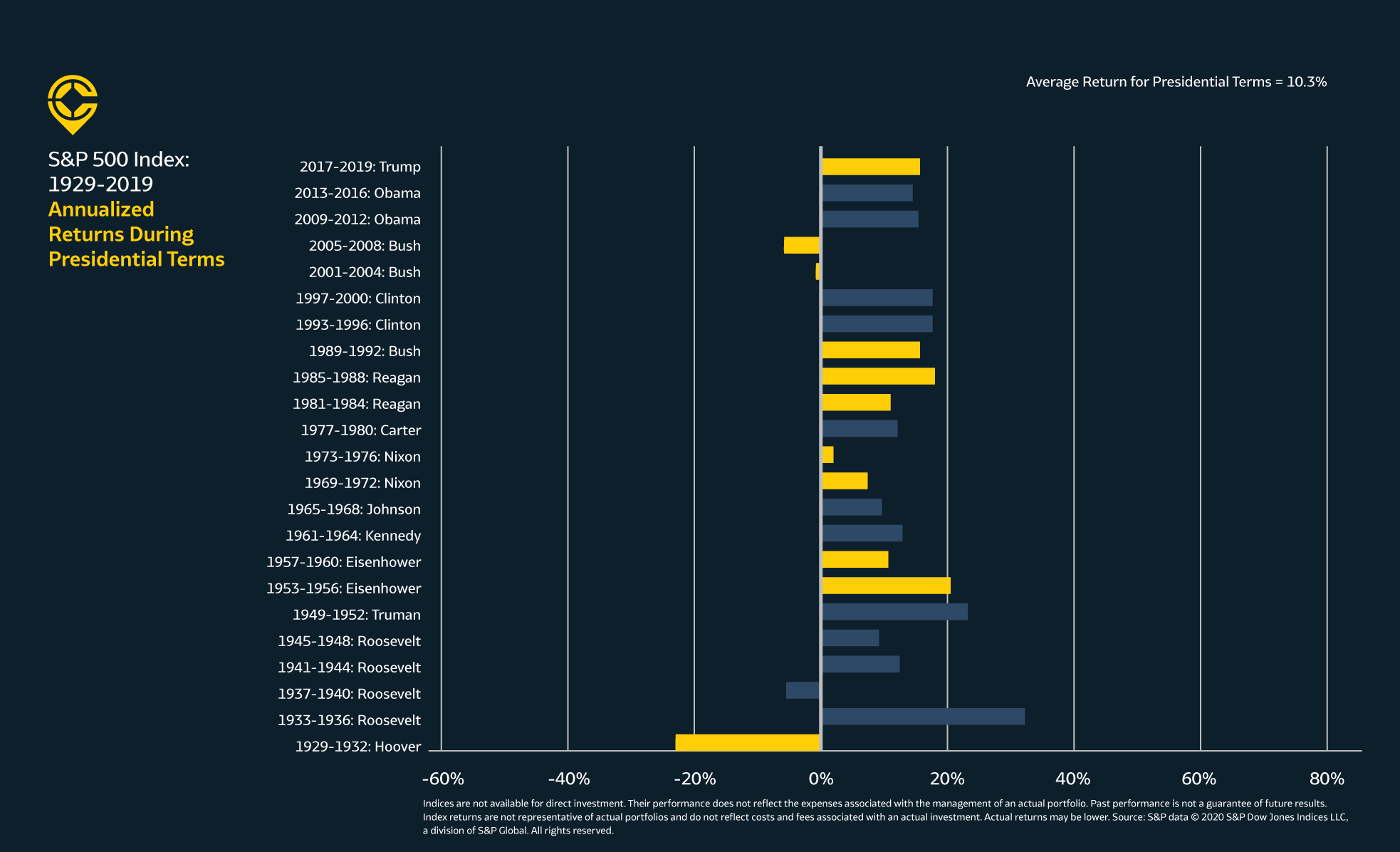

Often, I am asked: “should we move our portfolio to cash?” And that answer is always unequivocally, NO! Look no further than the 2016 election and suppose you were a diehard Democrat and sold your investments the day after Trump was elected. You would have forgone a gain of approximately 60% in Large US stocks on the equity allocation

within your portfolio! Ultimately, what drives performance in the market is not the presidential cycle but the overall macroeconomy.

So, what does all this mean to you and your portfolio? The most important takeaway from the research is not letting short-term emotions deter you from your long-term planning and investing goals. Whether it is an election, a trade war, a global pandemic, or otherwise, it is essential to maintain a fully invested, globally diversified portfolio in all environments. This strategy has proven most effective in giving you and your family the best opportunity to reach your goals.

I hope you find the following research and insights informational, if not somewhat reassuring, as the election unfolds in what is sure to be a contested election.

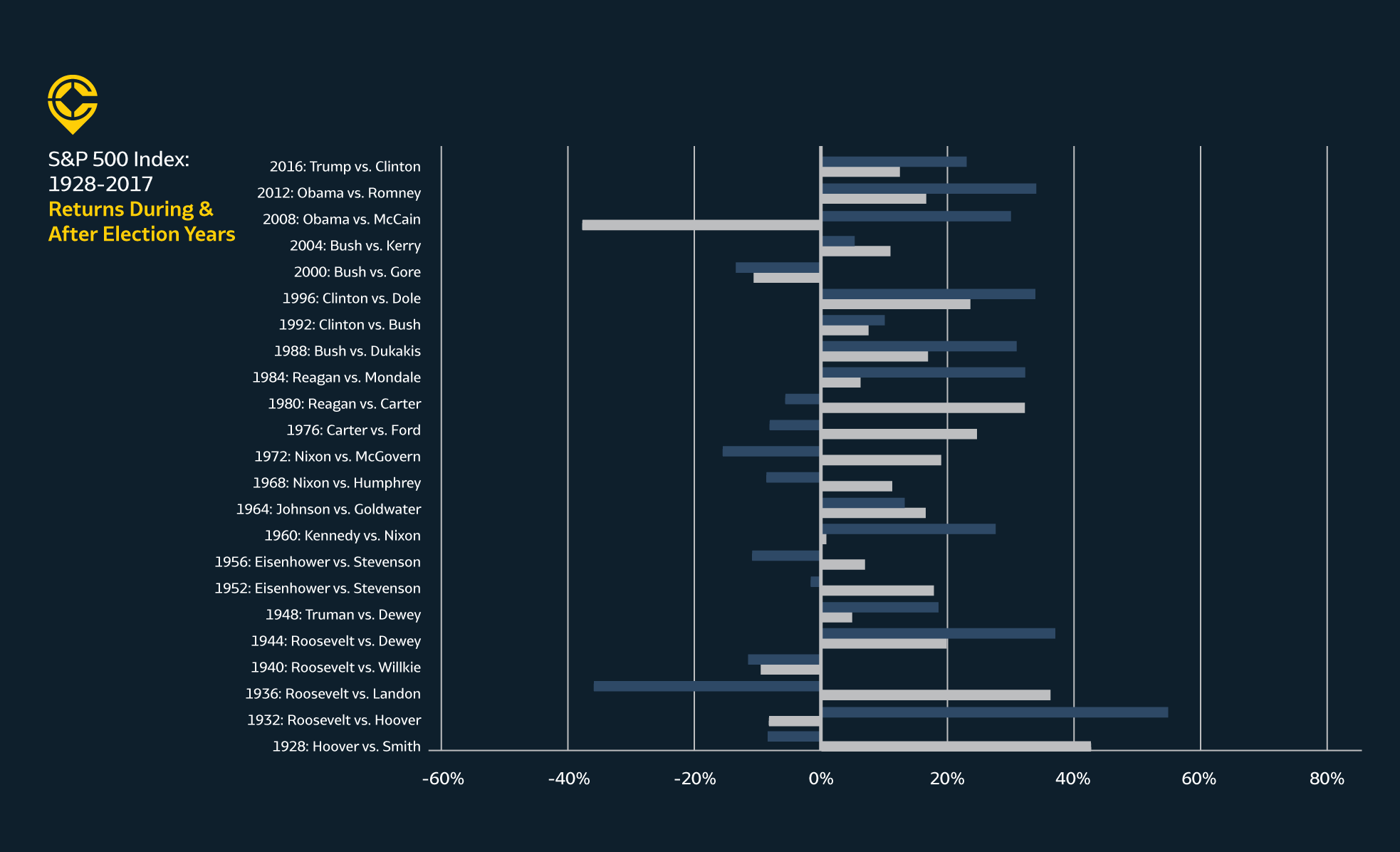

It is difficult to identify systematic return patterns in elections years

On average, market returns have been positive both in election years and the subsequent year

Market expectations associated with election outcomes are embedded in security prices

Read the next post in our Special Election Edition series:

Student of the Market

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein.