Flat Fee Financial Planning in Action: Getting the Right Advice at a Fair Price

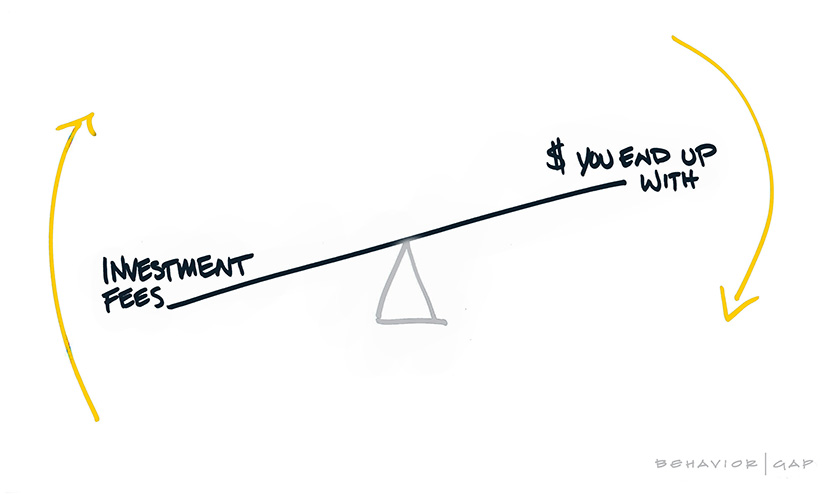

In our work with clients, we spend a lot of time explaining why we think flat-fee financial planning is the best way to deliver financial advice. Our flat fee scale is based on complexity, so a simpler plan requiring less analysis and implementation would carry a lower fee than a plan with more variables.

Let us compare this to an asset-based fee. These fees apply whether the assets increase due to the market, the advisor’s skill, or if the investor adds money from another source. In theory, this incentivizes the advisor to maintain appropriate risk levels to minimize market and portfolio downturns to protect assets from decreasing. However, in practice, this can lead to inappropriate risk-taking in an attempt to increase assets – so that AUM-based fees will go up. And if the products also remunerate the portfolio manager, there is an inherent conflict of interest in selecting suitable investment vehicles.

Flat-fee financial planning solves these problems. First, it puts a premium on the advisor’s experience and skill. The advisor needs to bring comprehensive knowledge to bear on your situation from across the full spectrum of financial planning. As you move through life, your situation will change, and you will need different advice. A skilled advisor can be a guide as your goals change and as the inputs in your financial plan evolve.

Successful financial planning advice links your portfolio to your goals – so keeping an appropriate level of risk and providing objective advice is critical to keeping you on track. Fee-based financial advisors are not paid a commission on products. They select the right product for you and are free to find cost-effective options that will attempt to preserve returns.

The following is a hypothetical situation we routinely come across.

The Current Situation

Greg and Ellen are both 75 years old and are drawing adequate income from their $3mm portfolio, but they wanted to know if they could do more with their money, for example, help grandchildren and begin to think about a legacy. They also wanted to be sure that they would be provided for. They were concerned about the viability of their portfolio with inflation at 40-year highs and increased market volatility.

An In-Depth Financial Review Revealed Significant Cost Savings – and More

They were holding assets at Fidelity, Vanguard, Transamerica, and Ameriprise.

The collective annual fee across all assets was $22,000, and for the assets held at Fidelity and Ameriprise, the asset-based fee was well over 1% – excessive in our professional opinion. They were not receiving any financial planning advice, and Columbus Street performed an in-depth review of Greg and Ellen’s entire financial situation.

- Current income from all sources: social security, pensions, investment & savings accounts

- Current lifestyle expenses

- Risk mitigation (insurance review and analysis)

- A detailed review of current investments and cost/benefit analysis

- Non-investment assets (second/vacation home)

- Estate planning and trust review

We also had a detailed conversation about their goals, desire to gift the children and grandchildren, contributing to charities that are important to them, and their flexibility if it became prudent or necessary to sell their family vacation home in the event of a prolonged long-term care event.

The Outcome

We made several portfolio recommendations:

- Columbus Street’s flat fee for managing the assets and providing comprehensive financial planning is $7,500 annually. This is a cost savings of approximately $15,000! Greg and Ellen immediately decided that this “found money” would be split annually between their annual philanthropic intent and gifts to their grandchildren.

- After reviewing their portfolio, we rebalanced their asset allocation to mitigate volatility and reduce the amount of money they were spending on internal portfolio expenses. As a result, the final portfolio had a lower risk profile while being mindful of trying to outpace inflation over the long-term and reducing their current internal portfolio expenses of approximately 1% to .5% – saving them roughly another $15,000 annually by decreasing their cost of investment management!

- A portion of their income came from an annuity they had held for several years with internal expenses of over 3%. We helped them exchange their current annuity for a low-cost, flat fee-based annuity with internal expenses of 0.2%. Again, reducing Greg and Ellen’s cost of investing allows their wealth to work harder for them, not the insurance company.

On the financial planning side, Columbus Street was able to work with Greg and Ellen to create a new, comprehensive financial plan that reflected changes in their outlook and goals for where they want to put money to work on a living inheritance as well as a legacy to their family and community.

- Created a plan to assist grandchildren in funding their educations

- Set up a schedule of annual gifts to their church

- Worked with their estate planning attorney to update their trust to accommodate their new goals and to update beneficiaries

- Addressed the risk a long-term care event would pose to their plan. It was determined that they would sell their lake cottage if necessary.

We provided Greg and Ellen with comprehensive financial planning custom-tailored to their goals, the unique risks of their life stage, and their desire to leave a legacy – all for one-third less than they were paying for their existing portfolio management.

Greg and Ellen, along with their adult children, now have the clarity that they have a high probability of achieving their long-term financial planning goals and the peace of mind that a good portion of their current wealth will pass to their children, grandchildren, and the charities they are passionate about.

At Columbus Street, we are passionate about helping our clients achieve their goals and dreams. Our flat fee, client-first fiduciary advisory model, provides individuals and families the clarity and peace of mind their interests come first without the conflict of the assets under management model. While other established advisory firms impose fee minimums, we like to think in terms of a fee maximum.

To learn more and have a no-obligation introductory conversation on how Columbus Street might be able to provide you with planning and investment management for one flat price, schedule a meeting with us today.

Shawn Ballinger, CFP®

Founder & President

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein.