Flat Fee Pricing Highlights Dreams, Not Decimals

Finances are complicated enough. Pricing financial advice shouldn’t be.

Should you pay more for financial advice simply because you have been more financially successful or been more diligent in saving for your future? Does a car salesperson ask you your income before giving you his or her best price? No, they do not nor do almost all things we consume have a price contingent on our income and net worth.

Columbus Street provides a new alternative to traditional financial advice models. The price of financial and investment advice should transparent, easy to understand, and based on the complexity and needs of the client. While most financial service firms begin their fee structure at 1% of a client’s assets, and then tack on underlying investment expenses that usually add another 1%, all-in fees, and expenses can quickly add up to over 2%!

Columbus Street believes traditional financial service models fail clients by charging excessive fees that add more value to the advisor and the firm they work for than the clients they serve. At Columbus Street, the goal is to keep the cost of all-in wealth and investment management advice under 1% to create a true exchange of value with each client relationship. As you will see, most financial services firms are not built to serve clients with this ideology and at a price-point favorable to you, the client.

First, let us review financial service models and advisor compensation structures.

Commission-Based Model

Dominant in the ‘70s and ‘80s, and still today most commonly associated with insurance and annuity product sales, commissioned-based “advisors” have a product they want to sell you. Ever met a life insurance salesman that could cure all of your financial worries with a cash value life insurance policy or a “guaranteed” annuity? The salesperson may even tout the advice as “free” and at no cost to you during the product pitch. These products by themselves are not all bad, but when used in the wrong manner and misaligned with the client’s goals, can lead to disastrous results and potentially permanent destruction of wealth.

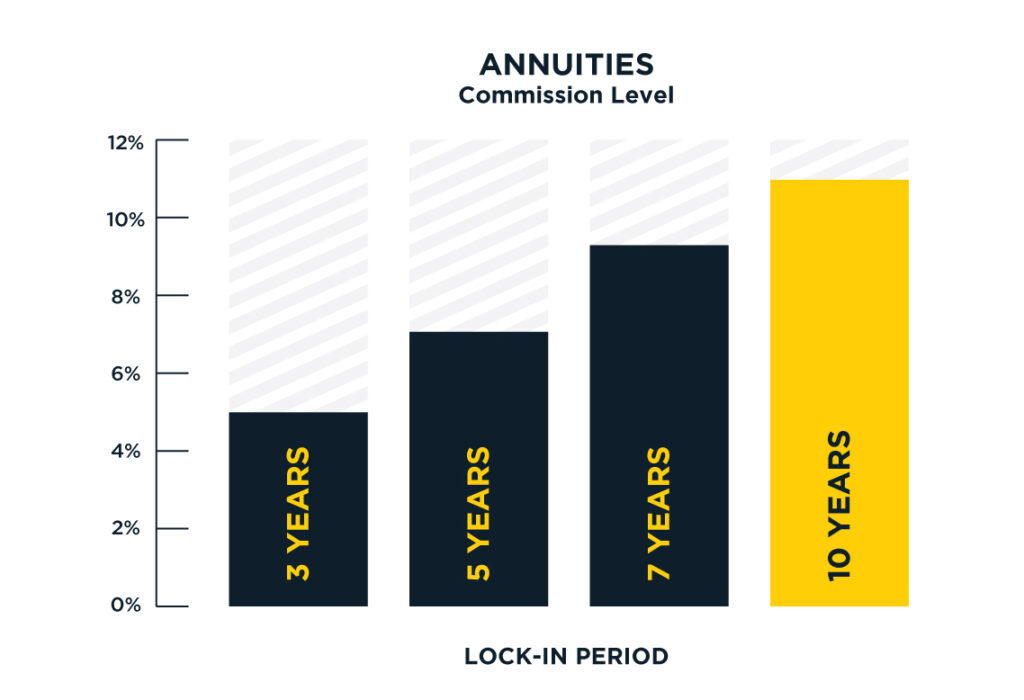

*For Illustrative Purposes only

So how much does your “free advice” really cost? Assume you have $1,000,000 to invest. Your commissioned advisor recommends an annuity with a 10-year surrender charge. Remember, the insurance company and their representative are not fiduciaries; their interests are above yours. While there is no cost to you, you cannot touch your money for ten years without incurring a “contingent deferred sales charge.” At that level, your advisor and the agency they work for could receive as much as $110,000 commission or 11% of your total investment. If it sounds like a lot – it is. The insurance company is not paying the commission of course – you are along with all of the other people who purchased the product that will likely have 2-3% annual internal cost structure for all of those promises and guarantees. There is a reason life insurance contracts are long and difficult to understand – they do not want you to read them and fight hard lobbying Congress to keep it that way.

Fee-Based Model

Fee-based advice is one of the more difficult compensation models to detect. Many fee-based advisors will tout themselves as a fiduciary, but be careful, your advisor may be wearing two hats. While the upfront financial advice fee structure may look like a reasonable price, he or she may also be receiving commissions on investment and insurance products they have sold to you. Fee-based models are typically found in large banks, and investment and insurance brokerage houses – think of nationally recognized firms that sponsor professional golf tournaments. While brokerage firms’ primary business is managing your investments, their representatives are also heavily incented to cross-sell expensive insurance products such as annuities, life insurance and long-term care insurance.

Fee-Only AUM Model

Assets Under Management (AUM) rose to popularity in the ‘90s as many commissioned based advisors and insurance agents saw a way to diversify their revenue streams and maintain client relationships. In the AUM model, fees generally start at 1% to 2.0% (anything over 1% is nosebleed pricing but they still exist!) and then decline on a percentage basis the more assets the client has. It was a good model from a transparency perspective, and often communicated to the client “we do well when you do well.” Based on long-term market averages, AUM firms know the market historically has positive performance seven out of ten years, negative two, and generally flat once every decade. And over time, the firm’s revenue can grow exponentially and become lucrative for owners and stakeholders.

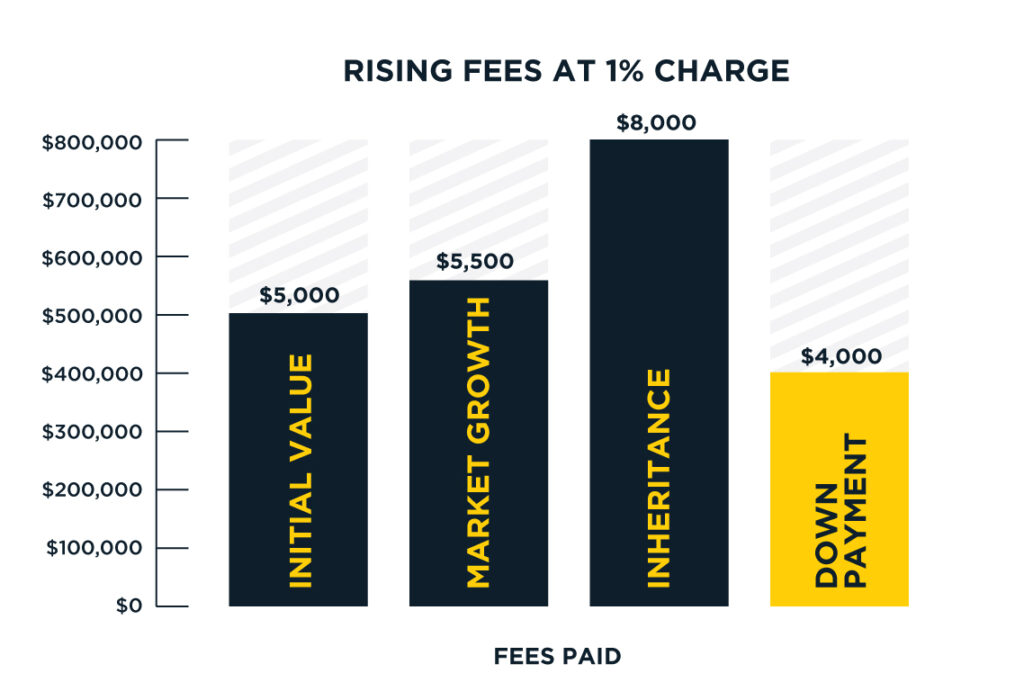

But here is the secret: It does not take any more time and resources to assist Client A in managing their $500,000 portfolio than it does Client B’s $1,00,000 portfolio! Of course, there is significant differences between a $1,000,000 portfolio and a $10,000,000 portfolio and the time, complexity of planning each client will require. However, the service level for most clients is the same and requires little to no variation in time and attention required to provide fiduciary advice! So, the obvious question is should the AUM advisor be compensated more simply because Client A has a few hundred thousand dollars more than Client B – or better yet – be paid more across the board simply because the market went up 30% last year? The answer is no, not at all.

One of the inherent flaws in the AUM model is the advisor does not have incentive to recommend you withdraw from your portfolio such as taking money from your portfolio to put a down payment on a home.

With technology driving efficiency and productivity more than ever, AUM firms’ margins have grown significantly in the last thirty years to the benefit of owners and shareholders. The irony is the fee-only AUM model has suspiciously started to look like the empire building brokerage model of old. Firms are engaging in private equity roll-up strategies and growth for the sake of increased profitability but have not used their size and scale to pass along the cost savings to the clients they serve.

Fee-Only Flat-Fee Model

Columbus Street believes in fee-fairness, not margin maintenance. The fabric of Columbus Street is delivering fiduciary advice based on the needs and complexity of the client’s situation. In speaking with many advisors, especially those entrenched in the AUM model, they continue to maintain charging anything less than 1% of a client’s assets is a “race to the bottom.” We say, “old habits die hard.”

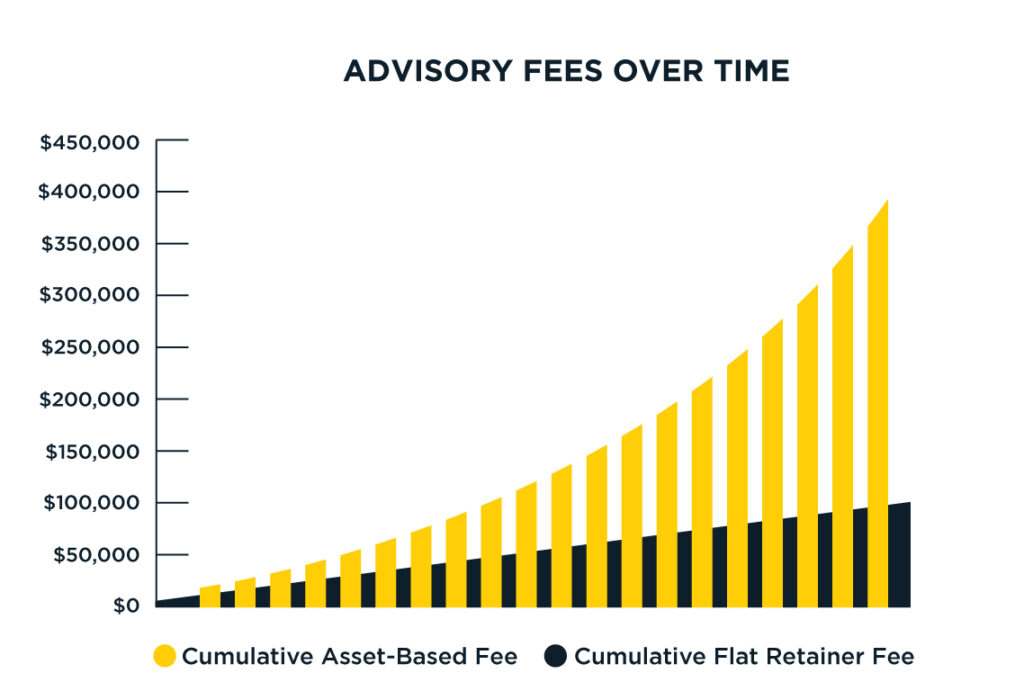

For Illustrative purposes only.

Let us look at the illustration above and the impact a typical 1% assets under management model has to a flat-fee model. We will assume a $1,000,000 portfolio and a 30-year retirement time horizon. The flat-fee model’s price begins at $5,000 and grows at an inflation rate of 3%, and the AUM fee begins at $10,000 (1% of $1mm), and grows at 6%, or a modest long-term investment return assumption.

The savings in fees in a flat-fee model versus the AUM model is more than meaningful – it is impactful! The difference in annualized savings of the flat-fee versus the AUM model means the client keeps more in their portfolio to do as they wish, whether it be travel more, gift more to their family, or purchase a long-term care policy to protect their wealth and well-being! Simply put, most AUM models cannot add the value required to justify the excessive fees over the duration of the relationship. Fee-Only AUM advisors are still fiduciaries, make no mistake, but it is certainly beginning to look like a “me first” model versus a “client first” mentality.

With technology, fiduciary awareness, simple logic, and a more sophisticated client, a flat-fee model is the future of comprehensive wealth management.

As a Fiduciary, Columbus Street strives to drive client-first value by delivering best in class wealth management in an Independent, Fee-Only, and Flat-Fee model that aligns with the goals and values of the clients we serve.

One flat-fee. No products. No guesswork. No conflicts.

Ready to come first? Let us know how we can help

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein.