Expanding Portfolio Horizons: Investment Opportunities Beyond Major Market Indices

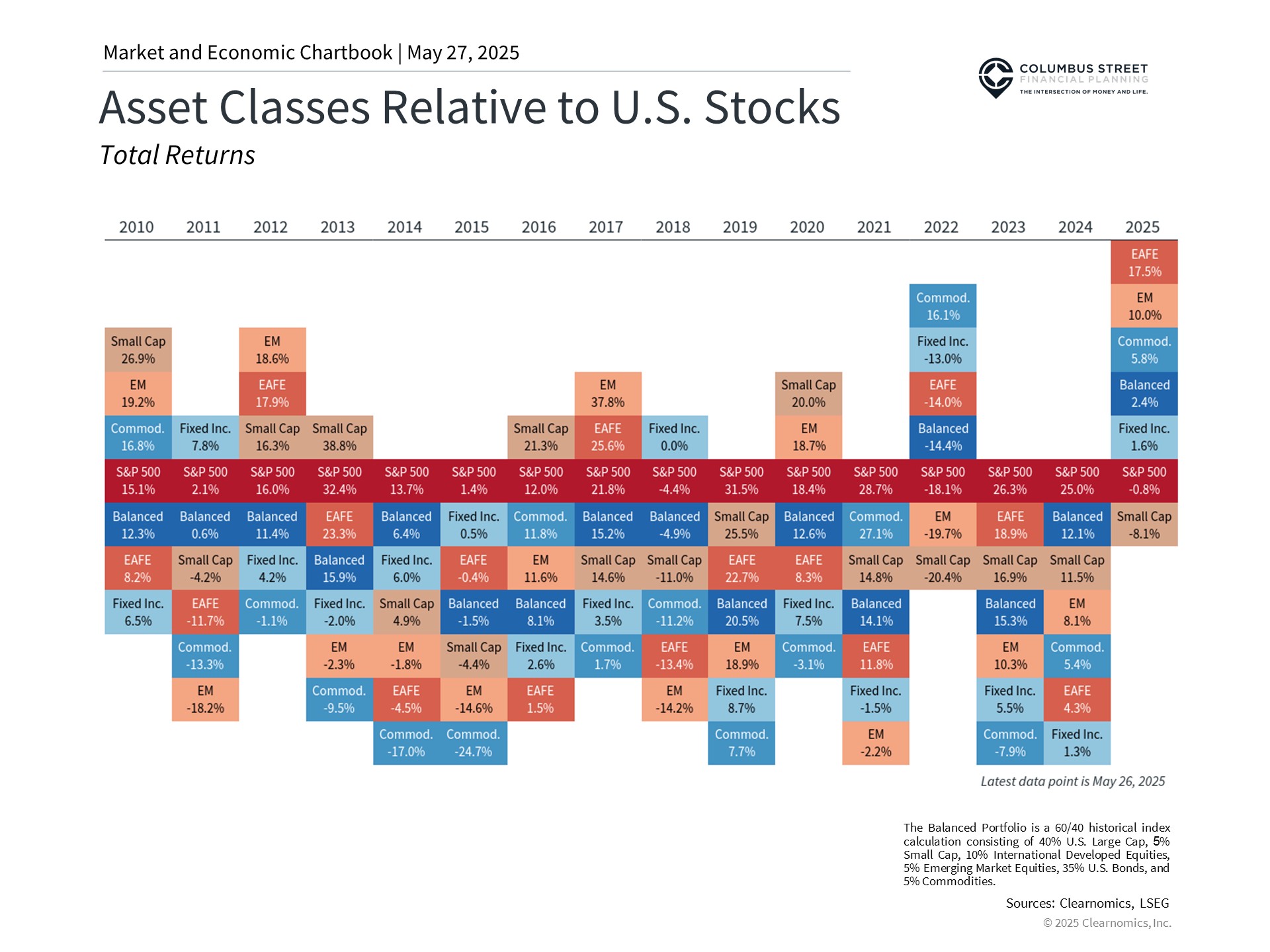

Equity investments form the foundation of long-term portfolios, traditionally generating substantial returns to help investors achieve their financial goals. While major indices like the S&P 500 and Dow Jones focus on America’s largest corporations and provide valuable insights into broad market trends, this concentration may cause investors to overlook other promising opportunities beyond mega-cap companies. Expanding investment perspective, investors might consider international and emerging markets and a prudent allocation to commodities, which offer unique characteristics and diversification benefits that can strengthen portfolios during periods of market volatility and economic uncertainty.

Financial markets are frequently viewed as equivalent to major indices such as the S&P 500 or Dow Jones Industrial Average. The S&P 500 represents an index monitoring the performance of 500 of the largest publicly traded corporations, organized by market capitalization as a measure of corporate size. The Dow encompasses merely 30 large, established enterprises. Both indices predominantly feature companies that are incorporated and based within the United States.

Given their construction methodology, these benchmarks concentrate exclusively on America’s largest corporations. This approach proves valuable for comprehending broad market trends and economic conditions, as the largest companies tend to influence these patterns. Nevertheless, when constructing investment portfolios, these indices might miss other promising opportunities. This consideration becomes particularly significant when a select group of “mega cap” companies, including members of the Magnificent 7, have been the principal sources of both gains and losses.

Within the current market landscape, how might investors expand their investment perspective? Small-capitalization equities and international markets represent two examples of sectors that may offer opportunities and portfolio diversification. Each provides unique characteristics and potential advantages that can strengthen portfolio diversification, particularly during periods of market turbulence and economic uncertainty.

Small-cap equities have underperformed but provide diversification advantages

Small-capitalization stocks encompass companies with market valuations typically spanning from several hundred million to approximately two billion dollars. This differs from medium and large-capitalization companies ranging from tens to hundreds of billions, while mega-cap entities are currently valued in the trillions.

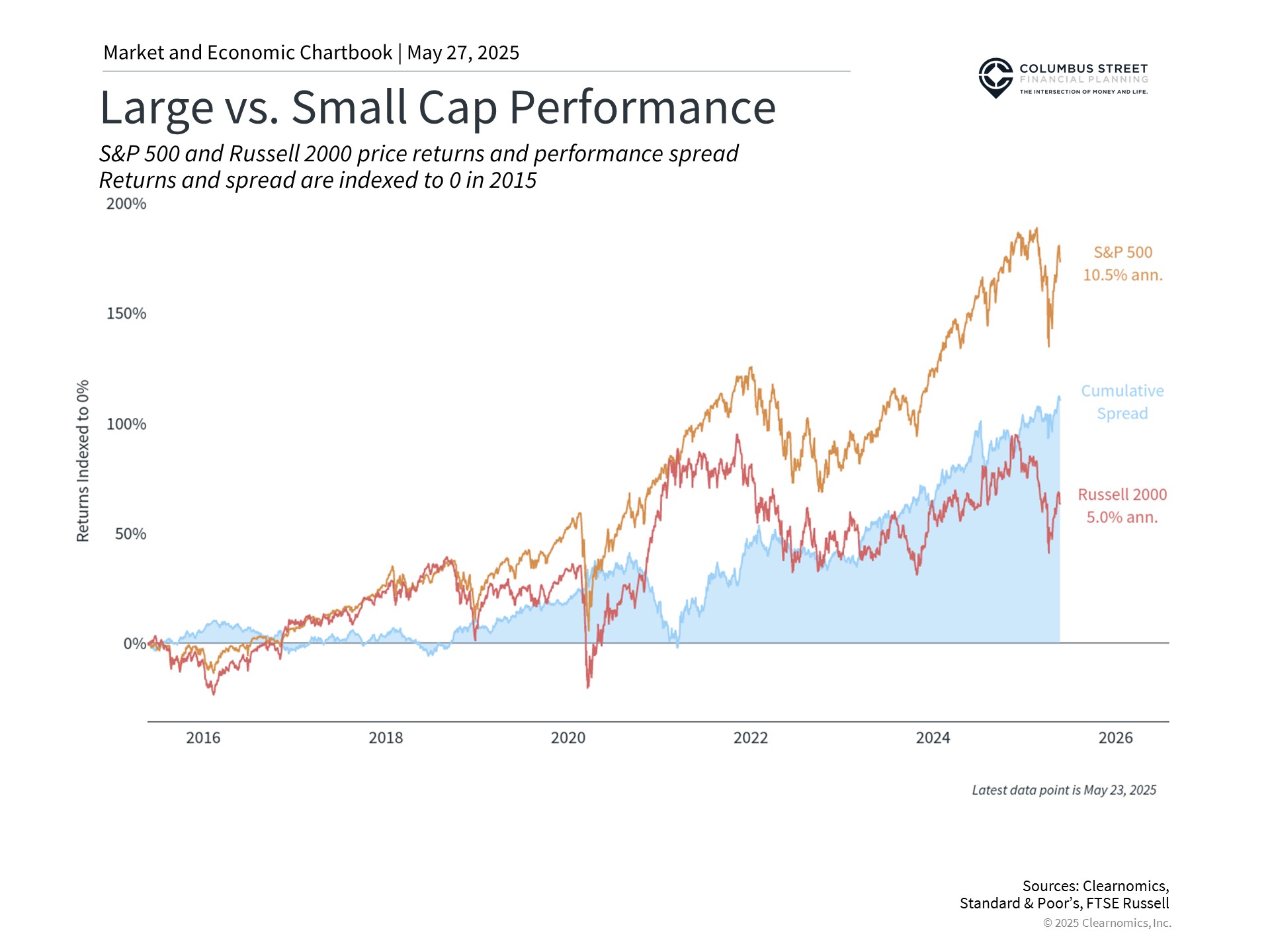

The Russell 2000 index, which monitors small-cap performance, has produced 5.0% annual returns during the previous decade versus 10.5% for the S&P 500, as illustrated in the corresponding chart. This performance disparity has been especially evident in recent years as market concentration among large and mega-cap companies has intensified, particularly within technology and artificial intelligence sectors. Small-cap enterprises generally maintain limited technology sector exposure and generate more revenue from domestic operations, creating sensitivity to shifts in U.S. economic policies and trade circumstances.

Significantly, small caps have faced challenges throughout this year due to persistent uncertainty regarding tariffs and economic expansion. Nevertheless, this situation has potentially created appealing investment valuations. Small-cap stocks currently trade at more reasonable price-to-earnings multiples relative to large-cap equities. The Russell 2000 presently maintains a price-to-earnings ratio substantially below its 10-year average. Even more notable is the price-to-book ratio of approximately 0.8x, significantly below the historical average of 1.2x. By contrast, many S&P 500 valuation measures exceed average levels, approaching historical peaks.

The interest rate landscape presents another significant distinction between large and small-cap enterprises. Small caps frequently depend more extensively on floating rate debt financing compared to their large-cap peers, creating greater sensitivity to interest rate changes. Although this generated difficulties when rates increased rapidly starting in 2022, the more stable environment since then could provide assistance. This becomes especially relevant if the Federal Reserve continues rate reductions later this year.

Many of these indicators suggest that small-cap stocks maintain more attractive valuations than numerous other market segments. While large caps will remain important components of many portfolios, this emphasizes that opportunities exist throughout various market sectors.

International markets maintain attractive valuations

Another sector offering compelling valuations is international equities, commonly divided into two primary categories: developed markets (including Europe, Japan, and Australia) and emerging markets (encompassing nations such as China, India, and Brazil). These classifications represent differences in economic development, market infrastructure, regulatory environments, and additional factors.

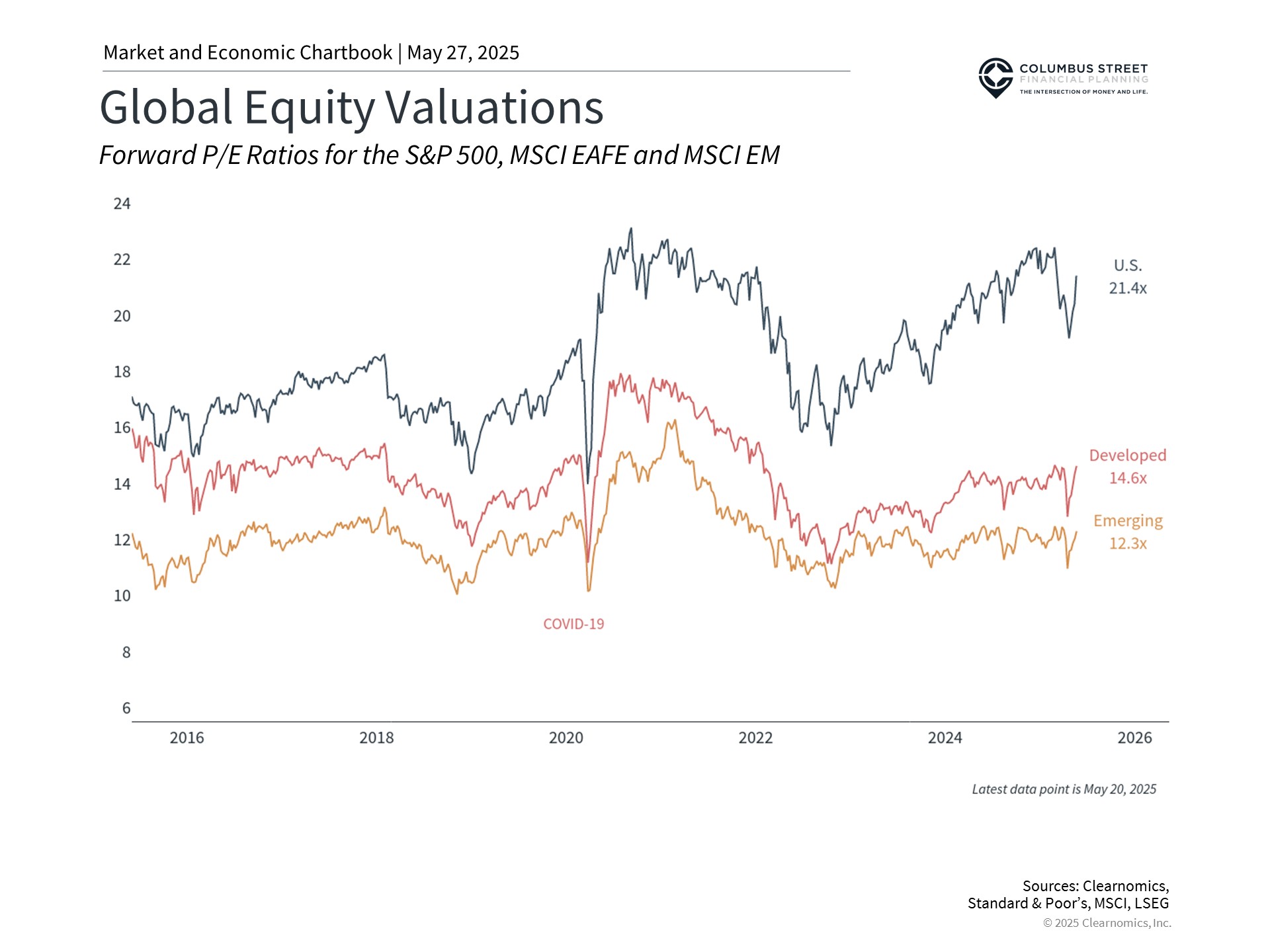

While U.S. equities have dominated global markets throughout much of the past decade, international stocks have demonstrated superior performance this year. The MSCI EAFE index, tracking 21 major developed market nations, has increased approximately 17.5% year-to-date in U.S. dollar terms. The MSCI EM index, monitoring emerging markets, has advanced 10%.2 This performance has occurred despite global uncertainty stemming from trade considerations.

Beyond superior performance this year, valuation disparities remain considerable. While the S&P 500 trades at elevated price-to-earnings multiples, international markets present more attractive valuations, as demonstrated in the chart above. This partially results from political and economic challenges across many regions during the past decade, some of which have started to improve.

A fundamental difference between U.S. and international investing involves currency fluctuation impacts on returns. Specifically, the weaker dollar has established favorable conditions for U.S.-based investors. This occurs because foreign assets appreciate when their denominated currencies strengthen, enabling conversion back to additional dollars. This currency benefit has meaningfully contributed to international stocks’ strong performance this year, providing supplemental gains beyond underlying foreign company performance.

Diversification across regions and market capitalizations remains essential

For long-term investors, maintaining exposure to sectors including small-cap and international equities can assist in creating more balanced portfolios. This becomes particularly relevant following the substantial performance of large-cap stocks driven by merely a handful of the largest companies.

This does not suggest that U.S. large caps will diminish in importance. This also does not advocate for substantial modifications to well-structured portfolios. Rather, maintaining long-term portfolios involves holding appropriate asset allocation across all these investment categories. By incorporating more attractively valued market segments, we can potentially enhance long-term risk-adjusted results and capitalize on market opportunities. While individual asset classes may underperform during specific periods, their varying characteristics and return patterns can deliver valuable diversification benefits over time.

The bottom line? Although the S&P 500 and Dow remain significant benchmarks, investors should evaluate the advantages of diversifying across numerous other market segments, including smaller enterprises and international equities. Maintaining suitable long-term portfolios continues to be the optimal approach for achieving financial success.

1. Russell 2000 and S&P 500, price returns, from January 2, 2015 to May 23, 2025

2. MSCI EAFE and MSCI EM, total returns, January 1, 2025 to May 23, 2025

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein.