At Columbus Street, we approach financial planning from a client-first perspective. It’s my fiduciary role to put your needs first while providing the transparency you expect from a Certified Financial Planner®. Part of providing informed financial planning for our clients is that we do what we can to keep you informed.

With widespread concern around the coronavirus outbreak, I wanted to share and echo a short statement below from our partners at Dimensional Fund Advisors. It offers a relevant perspective for investors facing volatility in the financial market, while also serving as a useful reminder that professional financial strategies and the market as a whole are both specifically designed to react to unforeseen events like this. Columbus Street and other fee-only financial planning services exist to protect and sustain the financial strength of our clients over the long run. That is our commitment to you, and it will always remain so.

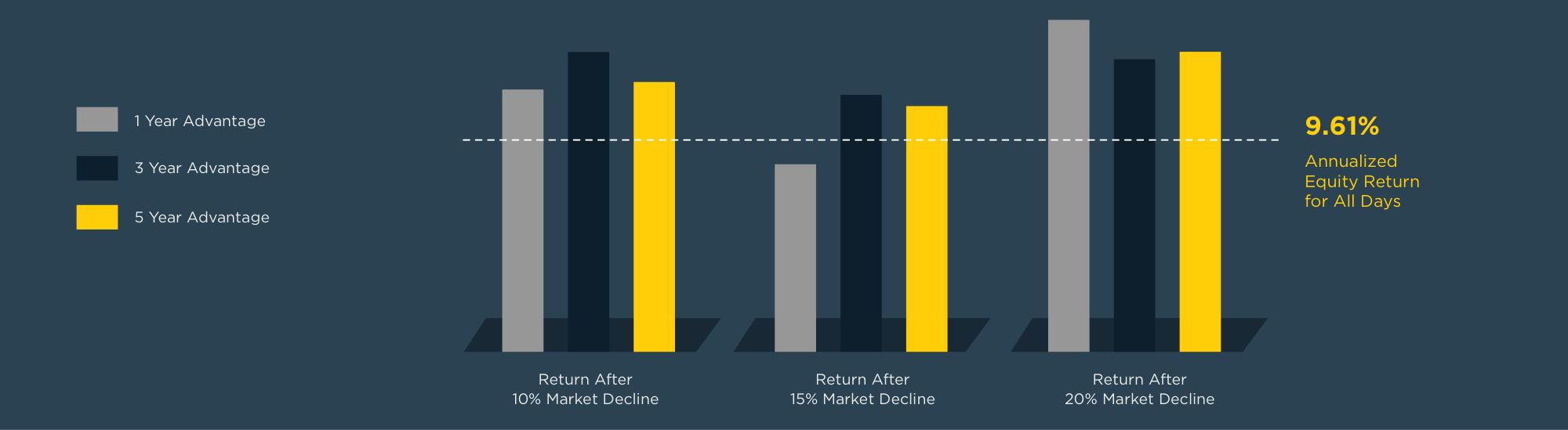

Sudden market downturns can be unsettling. However, US equity returns following sharp downturns have historically been positive.

- A broad market index tracking data since 1926 in the US shows that stocks have generally delivered strong returns over one-year, three- year, and five-year periods following steep declines.

- Just one year from a decline of 10% or 20%, returns were higher than the long-term average of 9.6%. And the return after a 15% decline was within half a percentage point of the average.

- Looking three and five years later also shows annualized returns averaged higher than the long-term average.

Tuning Out the Noise [Download]

The Coronavirus and Market Declines

The world is watching with concern the spread of the new coronavirus. The uncertainty is being felt around the globe, and it is unsettling on a human level as well as from the perspective of how markets respond.

At Columbus Street, it is a fundamental principle that markets are designed to handle uncertainty, processing information in real-time as it becomes available. We see this happening when markets decline sharply, as they have recently, as well as when they rise. Such declines can be distressing to any investor, but they are also a demonstration that the market is functioning as we would expect.

The market is clearly responding to new information as it becomes known, but the market is pricing in unknowns, too. As risk increases during a time of heightened uncertainty, so do the returns investors demand for bearing that risk, which pushes prices lower. Our investing approach is based on the principle that prices are set to deliver positive future expected returns for holding risky assets.

We can’t tell you when things will turn or by how much, but our expectation is that bearing today’s risk will be compensated with positive expected returns. That’s been a lesson of past health crises, such as the Ebola and swine-fu outbreaks earlier this century, and of market disruptions, such as the global financial crisis of 2008–2009. Additionally, history has shown no reliable way to identify a market peak or bottom. These beliefs argue against making market moves based on fear or speculation, even as difficult and traumatic events transpire.

Columbus Street Financial Planning also stands behind the important role financial professionals play in helping investors develop a long-term plan they can stick with in a variety of conditions. Financial professionals are trained to consider a wide range of possible outcomes, both good and bad, when helping an investor establish an asset allocation and plan. Those preparations include the possibility, even the inevitability, of a downturn. Amid the anxiety that accompanies developments surrounding the coronavirus, decades of financial science and long-term investing principles remain a strong guide.

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. Investors should talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their financial advisor prior to making any investment decision.

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein.