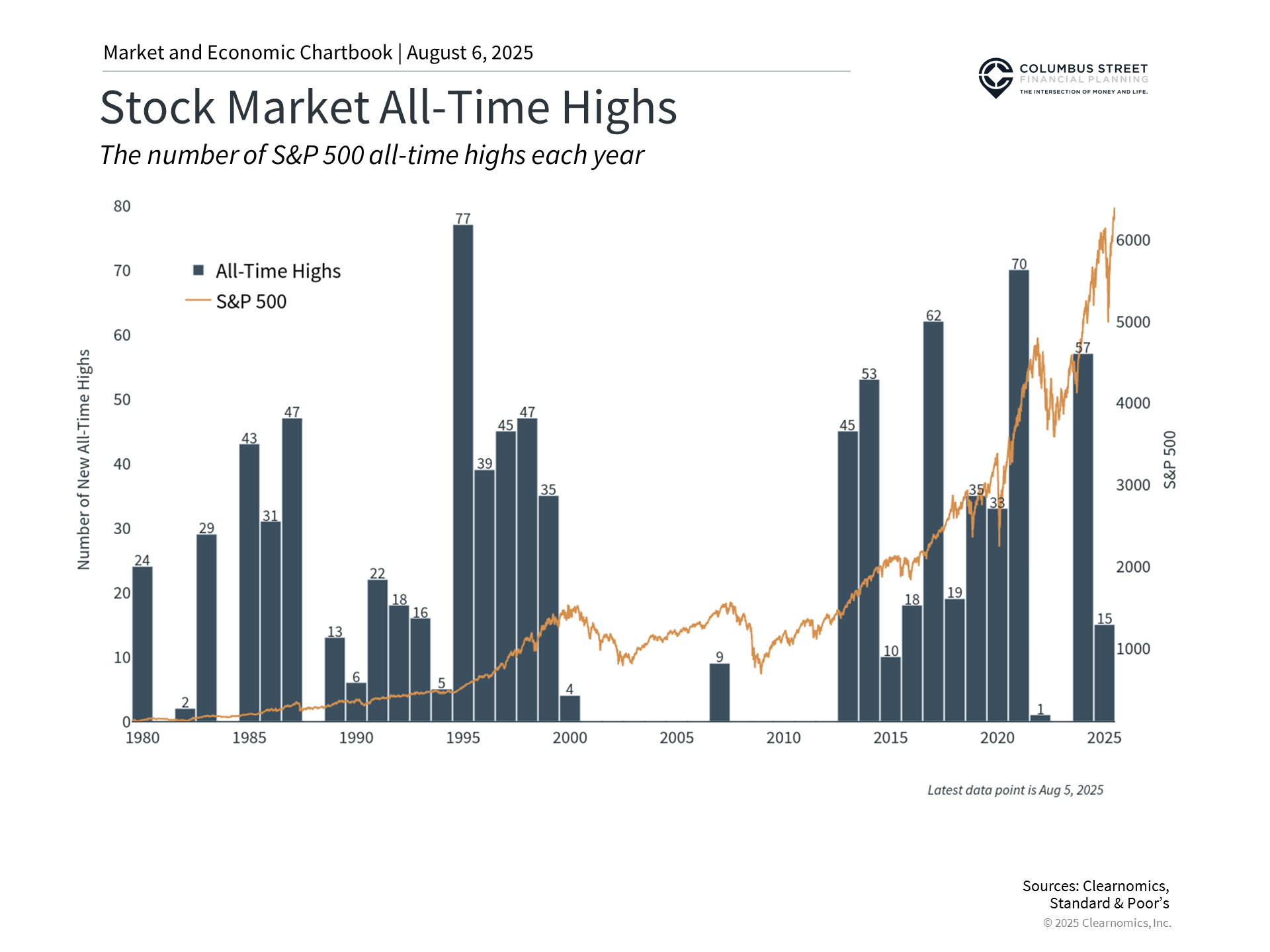

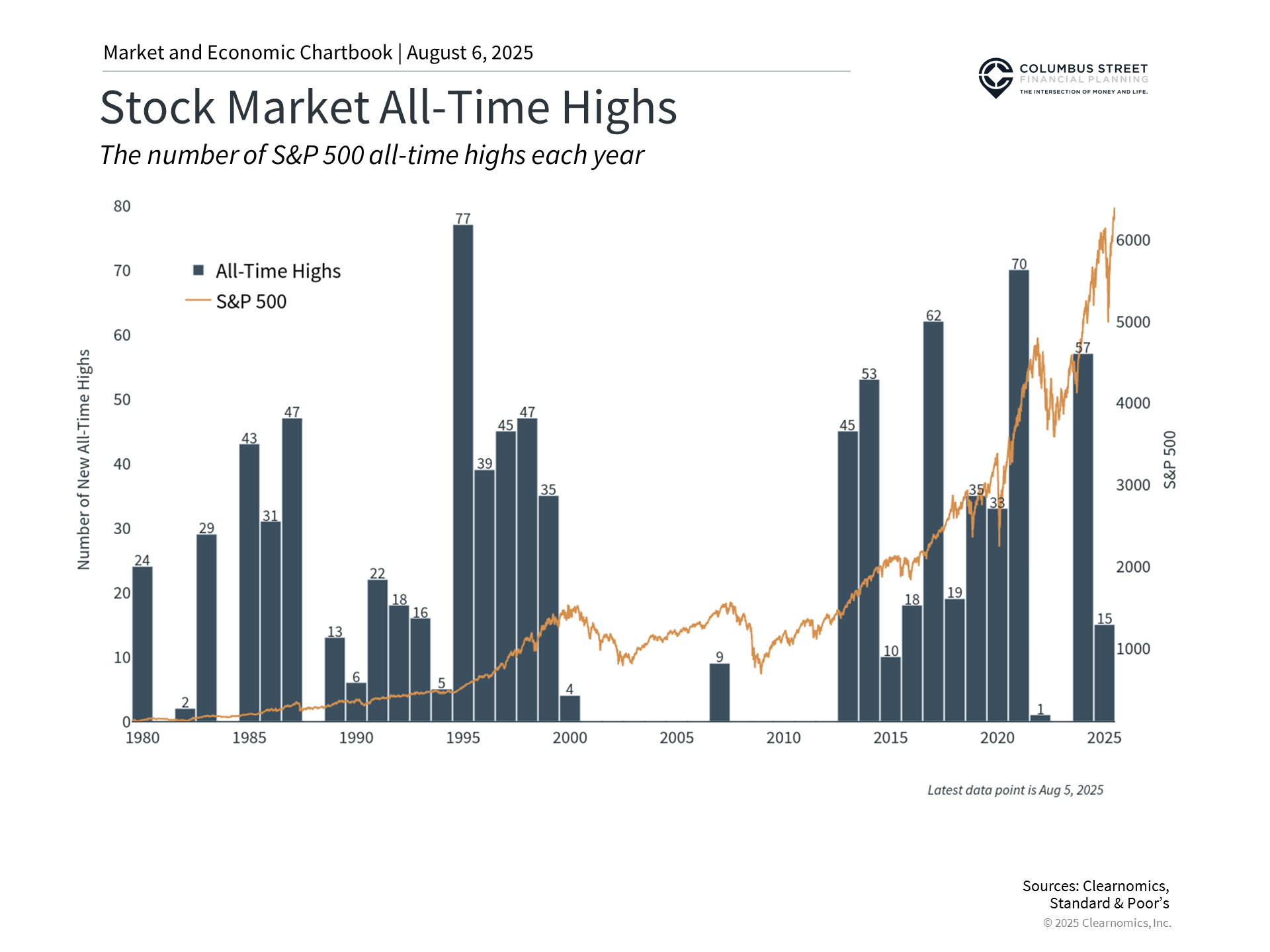

Markets continue to reach new all-time highs

Federal Reserve Projections and Economic Forecasts

While markets perform strongly, economic forecasters, including the Federal Reserve, anticipate modest inflationary pressure and potentially slower growth rates. Import-dependent industries face margin compression, though these challenges must be weighed against domestic investment benefits and corporate adaptation through innovation and operational efficiency improvements.

The predictability of current tariff policies may prove more important than their absolute levels. Stable business environments enable companies to optimize operations and supply chains more effectively than uncertain policy conditions.

Wall Street consensus forecasts project S&P 500 earnings growth at a 9.5% annual rate, with acceleration expected over the next two years as global trade stabilizes. However, significant variables could alter these projections between now and then.

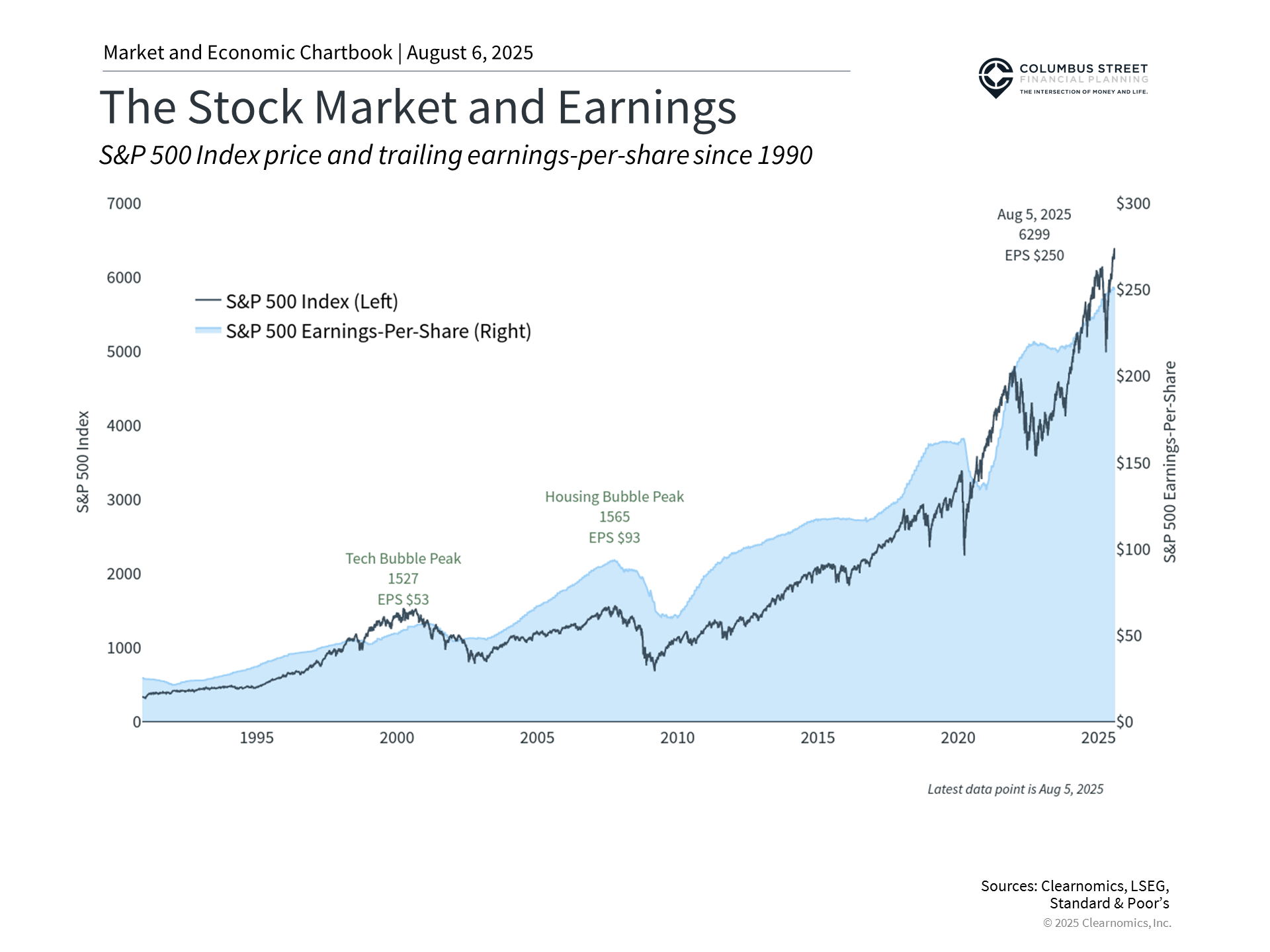

Earnings as Long-Term Return Drivers

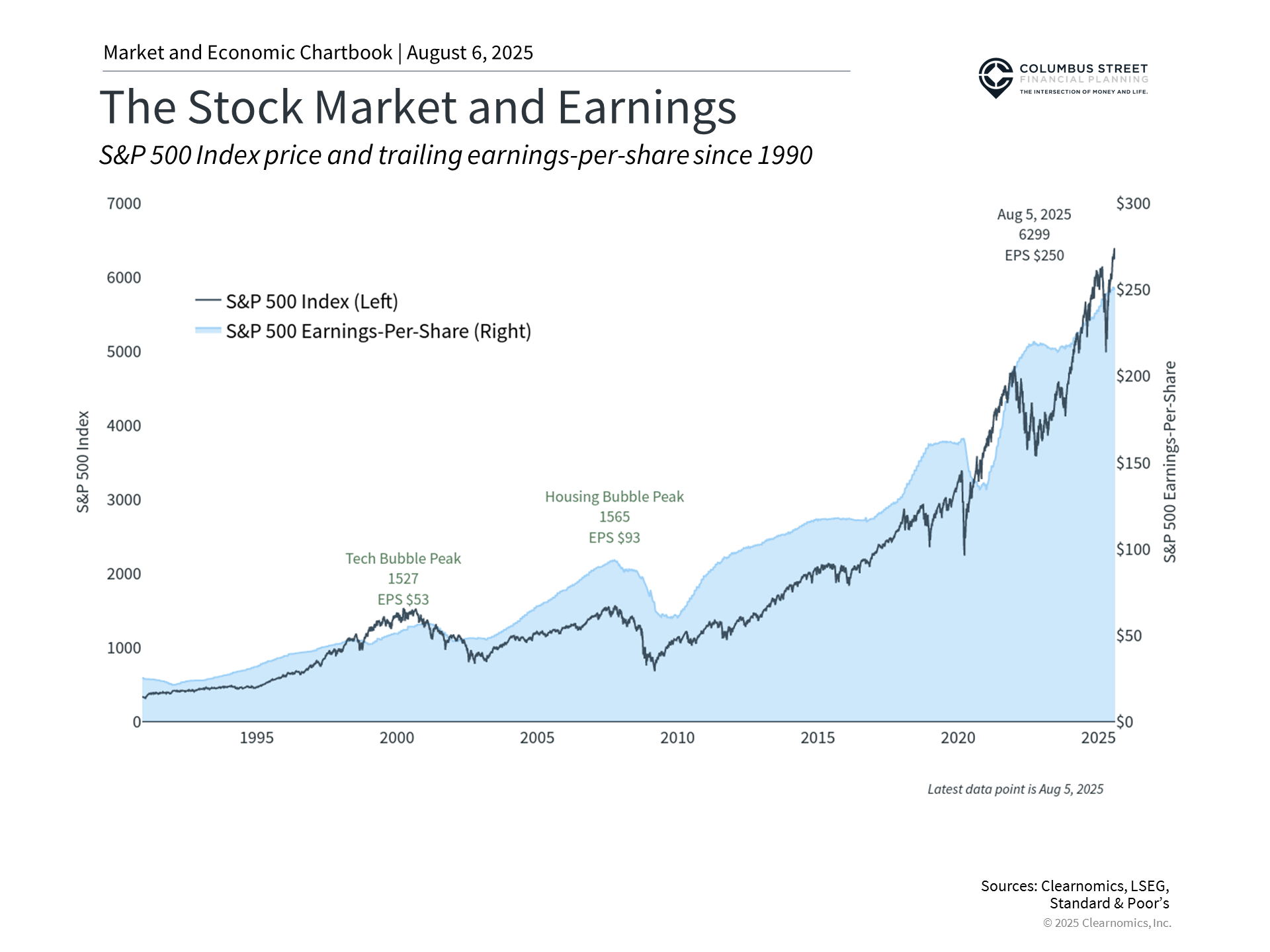

Historical market analysis demonstrates that stock prices generally track corporate earnings over extended periods. While short-term price and earnings movements don’t align perfectly, they follow consistent broad trends. Economic growth drives earnings expansion, which subsequently supports higher equity valuations. This relationship explains how tariffs impact corporate profits and can influence investor returns.

Earnings are an important long-term driver of returns

Market valuation assessments depend on both price levels and corporate performance metrics. The price-to-earnings ratio—calculated by dividing stock prices by earnings measures such as forward twelve-month projections—illustrates this dynamic. Even with stable prices, increasing earnings enhance market attractiveness, and vice versa.

The current S&P 500 price-to-earnings ratio stands at 22.2x, considerably above the historical average of 15.8x and approaching the dot-com bubble peak of 24.5x. While current earnings trends remain positive, continued market attractiveness will depend on sustained economic growth and earnings performance.

Investment Implications and Strategic Considerations

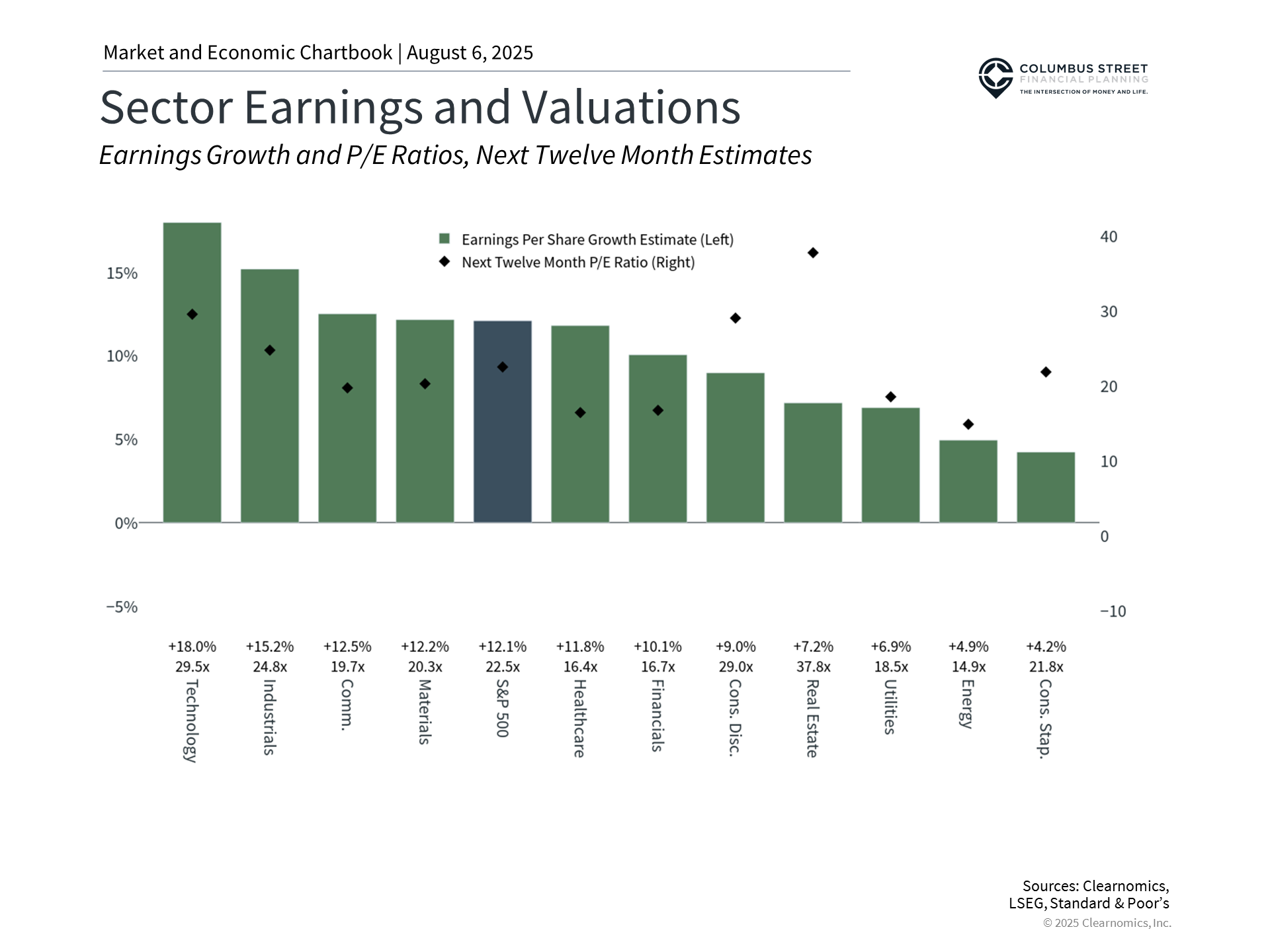

This earnings season provides valuable insights into tariff effects on consumers and businesses. Several quarters may be required to fully understand these impacts, particularly as new trade agreements continue to emerge. Sector-specific earnings expectations vary significantly, partly reflecting differential trade policy effects.

For investors, maintaining focus on long-term financial planning while understanding these evolving trends remains the most effective approach to achieving investment objectives. The current environment demonstrates that corporate adaptability and earnings growth can offset policy uncertainties when businesses maintain operational flexibility and financial strength.

The Bottom Line: Corporate earnings continue exceeding expectations despite elevated tariff levels, suggesting business resilience and effective cost management strategies. While trade policy uncertainties persist, emerging agreements and predictable frameworks enable better corporate planning. Investors benefit from understanding these dynamics while maintaining long-term investment discipline.