Investment legend Jack Bogle once noted that “successful investing is about owning businesses and reaping the huge rewards provided by the dividends and earnings growth of our nation’s—and, for that matter, the world’s—corporations.” This perspective remains particularly relevant as investors navigate today’s market conditions, where the value of equity ownership extends beyond capital gains to include the steady income stream that companies provide through dividend distributions.

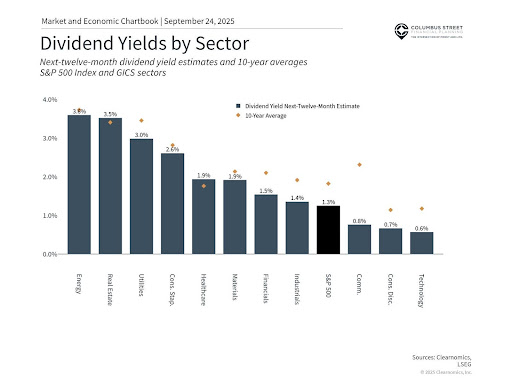

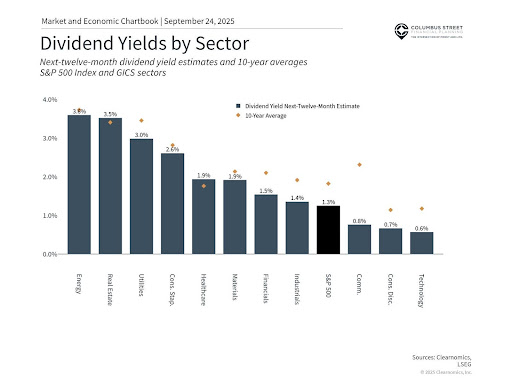

Current market conditions present unique challenges for income-focused investors. With equity markets trading near record levels, dividend yields across the S&P 500 have compressed to approximately 1.3% for the coming year—levels not witnessed since the technology bubble of 2000. This low-yield environment, combined with Federal Reserve policy adjustments and evolving interest rate dynamics, requires investors to carefully consider their income generation strategies.

Despite their reputation as less exciting compared to high-growth equities that dominate headlines, dividend payments deserve serious consideration in portfolio construction. These distributions accumulate through compounding and deliver reliable cash flows, particularly valuable during periods of market turbulence. Enterprises that successfully combine regular dividend payments with sustained stock price growth over extended timeframes can offer investors dual benefits: consistent income generation and long-term capital appreciation.

The contemporary investment landscape reflects fundamental changes in corporate capital allocation strategies and investor preferences that have developed over decades. How should today’s investors approach the balance between capital appreciation and dividend income in their portfolios?

Investor perspectives on dividend income have transformed significantly

Dividend investing has undergone substantial evolution throughout the past century. During most of the 1900s, dividend income represented the primary driver of equity returns, with yields frequently ranging from 5% to 7%. Investors approached stock ownership similarly to how they might view bonds today—focusing primarily on the income stream generated. Companies faced expectations to maintain and increase their dividend payments as evidence of strong financial performance, while stock price gains were often considered a secondary benefit to dividend income.

This approach shifted as investors increasingly gravitated toward technology companies and growth-oriented strategies. The technology boom of the 1990s accelerated the move away from dividend-focused investing, as high-growth tech companies typically reinvested their earnings rather than distributing them to shareholders. Stock repurchase programs also gained popularity as a more tax-efficient method of returning capital to shareholders compared to dividend payments.

Current low yields reflect this historical transformation. The accompanying chart illustrates how technology-focused sectors including Information Technology, Consumer Discretionary, and Communication Services provide the most modest dividend yields at 0.6%, 0.7%, and 0.8% respectively. These sectors encompass the Magnificent 7 companies, which typically offer minimal dividends or none whatsoever.

Conversely, traditional income-generating sectors like Real Estate, Energy, and Utilities continue to provide yields exceeding 3%, demonstrating that higher dividend opportunities remain available through diversification across different market segments.

These lower market-wide dividend yields don’t necessarily indicate a fundamental problem, as they reflect evolving market conditions and corporate strategies that can benefit investors in various ways. However, this trend underscores the importance of understanding how dividends function within corporate strategy, investor objectives, and portfolio management.

Business strategy and monetary policy influence dividend appeal

Companies typically deploy their earnings through two primary channels: reinvestment in business operations or cash distribution to shareholders via dividends. Theoretically, corporations should return capital to investors when they have sufficient resources for profitable growth opportunities or when their business model specifically targets income generation for shareholders, such as real estate investment trusts (REITs).

Yet dividends fulfill broader functions beyond merely distributing surplus capital. Many companies maintain consistent dividend payments to attract investors and demonstrate financial strength, especially when they can show sustained growth in these distributions over time. This dividend growth pattern signals corporate stability and management’s confidence in future profitability, extending beyond simple income provision.

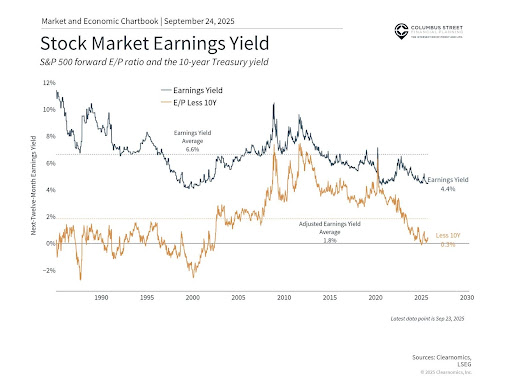

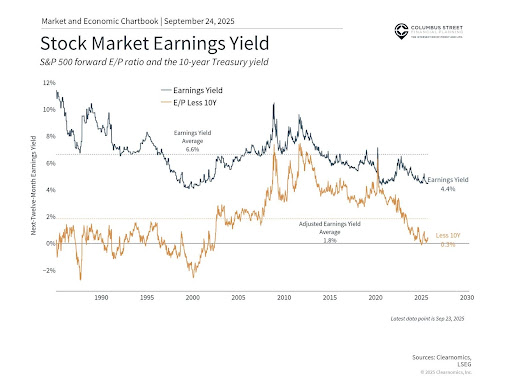

Federal Reserve policy and interest rate levels also influence the appeal of dividend-paying equities. When Treasury bond yields surpass dividend yields, they diminish the relative attractiveness of dividend stocks. Currently, with 10-year Treasury yields near 4.1%, government securities provide considerably higher income than the broad equity market. As the Fed proceeds with rate reductions, this relationship may evolve.

The accompanying chart displays the “earnings yield” concept, also known as the “equity risk premium,” which measures stock attractiveness relative to Treasury securities. The declining trend in recent years results from stocks reaching new peaks amid elevated interest rates. The stabilization of this metric this year reflects the recent range-bound nature of interest rate movements.

Dividend considerations remain crucial for portfolio management

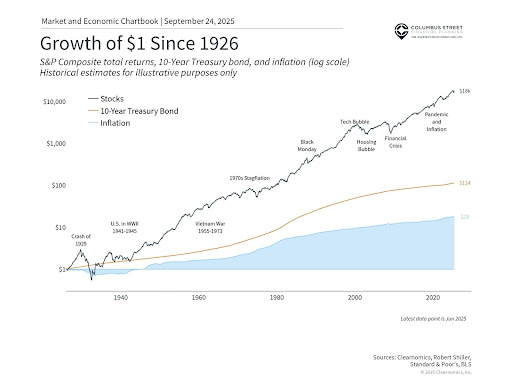

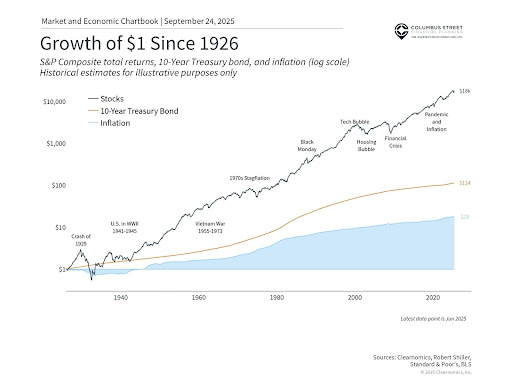

Dividends represent a fundamental component of total portfolio returns for investors. Standard and Poor’s data indicates that dividends have accounted for 31% of S&P 500 total returns since 1926, while capital appreciation contributed the remaining 69%.1 Contemporary investors typically concentrate on stock price movements, except when portfolio income becomes essential, such as during retirement planning or retirement years.

The accompanying chart demonstrates that $1 invested in equities in 1926 expanded to roughly $18,000 by 2025, illustrating the remarkable power of compound growth over extended periods. This expansion resulted from both dividend income and price appreciation, though the specific contribution mix varied across different historical periods. Some decades saw dividends drive most returns, while others were dominated by stock price gains. The consistent factor was the benefit of maintaining investment positions through various market cycles, regardless of the primary return driver.

Investors entering or already in retirement naturally emphasize current income generation. However, this doesn’t necessarily require exclusive focus on high-dividend securities. The hazard of “yield chasing”—pursuing only the highest-yielding investments—can result in inadequate diversification, concentration in companies with unsustainable business models, and insufficient growth potential for today’s extended retirement periods.

Therefore, investors should establish an optimal balance between dividend income and growth potential aligned with their financial objectives. This “total return” strategy ensures portfolios can generate suitable returns across various market conditions, whether through dividends, capital gains, or both components.

The bottom line? Although dividend yields have reached historically low levels, they remain a vital portfolio component. Investors should maintain focus on both capital appreciation and dividend income while pursuing their financial objectives.

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein. Clearnomics, “The Role of Dividends as The Feds Cut Rates,” September 2025, www.clearnomics.com