Consumer financial health serves as a critical barometer for the overall economy. With consumer spending accounting for roughly 70% of total economic activity, consistent purchasing patterns have been a key driver behind economic growth surpassing forecasts in recent years. Nevertheless, emerging signs of consumer fragility have sparked concern among investors contemplating the possibility of a recession.

Current media reports suggest mounting debt burdens and increasing payment delays, fueling anxiety about inflation and decelerating growth. Conversely, alternative economic indicators reveal robust consumer balance sheets, unprecedented household net worth figures, and sustainable payment obligations. This seeming paradox has prompted many investors to question which story is accurate and whether underlying vulnerabilities are developing.

The resolution to this puzzle involves recognizing what economists refer to as a “two-speed economy,” characterized by divergent financial circumstances across consumer groups distinguished by income levels, asset holdings, credit ratings, and other factors.

Although the financial pressures facing significant portions of the population warrant serious attention, distinguishing between individual-level impacts and market-level implications is essential. Indicators of consumer well-being must be evaluated within a comprehensive framework that encompasses savings patterns, debt payment ratios, and aggregate net worth. This holistic perspective clarifies why financial markets have maintained relative stability amid these headwinds.

Payment delays are increasing across categories

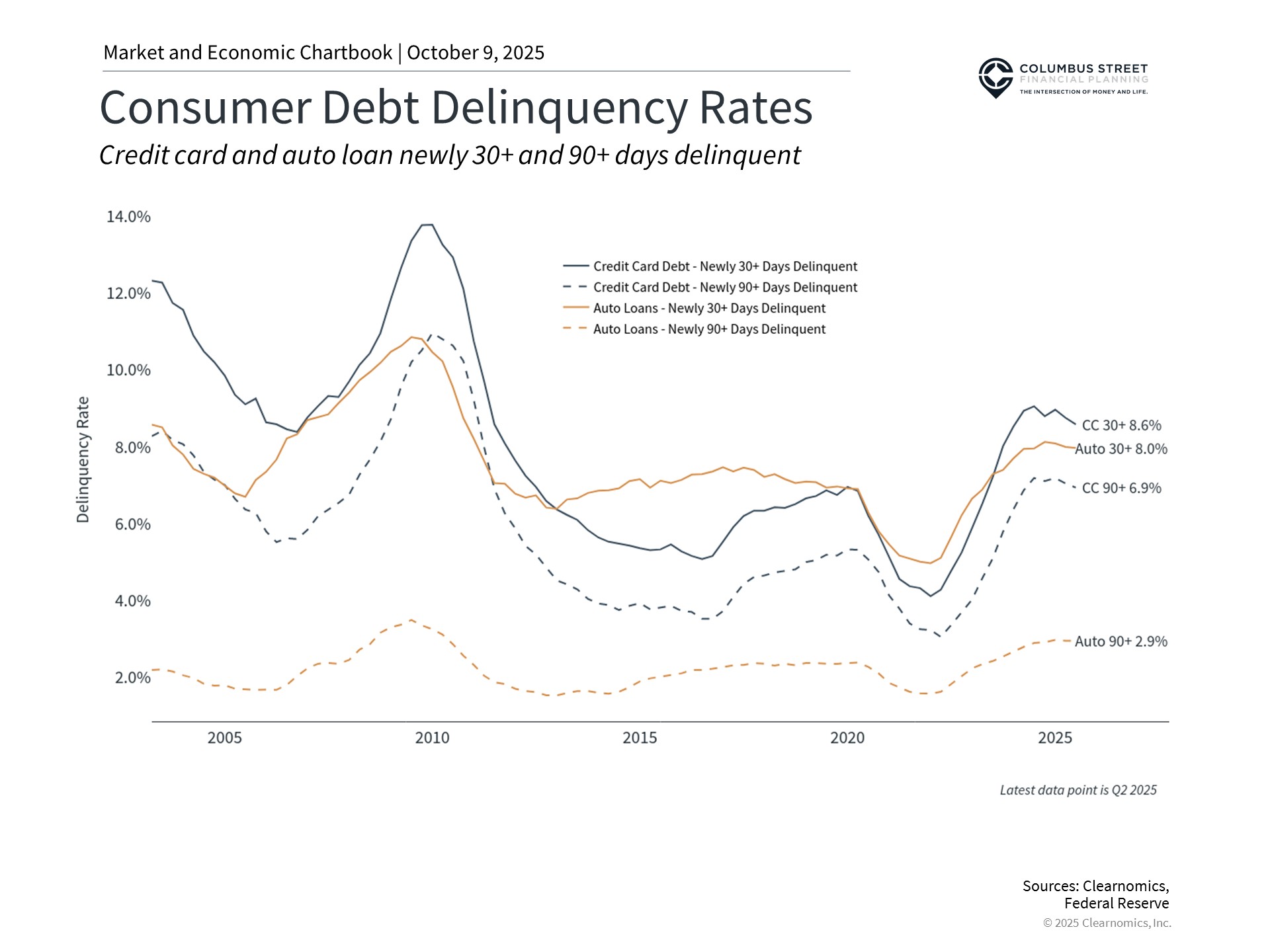

Among the most scrutinized metrics of consumer financial pressure is the rate at which borrowers fall behind on loan obligations. Payment delays can arise from numerous circumstances and occur when consumers miss scheduled debt payments. The accompanying chart demonstrates that both credit card and auto loan delinquency rates have climbed substantially over the previous two years.

Payment delays are generally categorized in phases according to how many days past due a payment becomes. Initial delinquency begins at 30 days overdue, with progressively greater concern at 60 and 90+ days. New delinquency transitions warrant particular attention because they identify consumers who have just started experiencing payment difficulties. The rise in 90+ day credit card delinquencies indicates that certain consumer segments are confronting persistent financial hardship.

Auto loan payment delays merit special consideration because consumers generally give these obligations priority, even when facing financial constraints. The reasoning is straightforward: vehicle access remains vital for work commutes and everyday needs. This pattern was especially evident during the housing crisis, when numerous mortgages became “underwater” – meaning homeowners’ debt exceeded their property values.

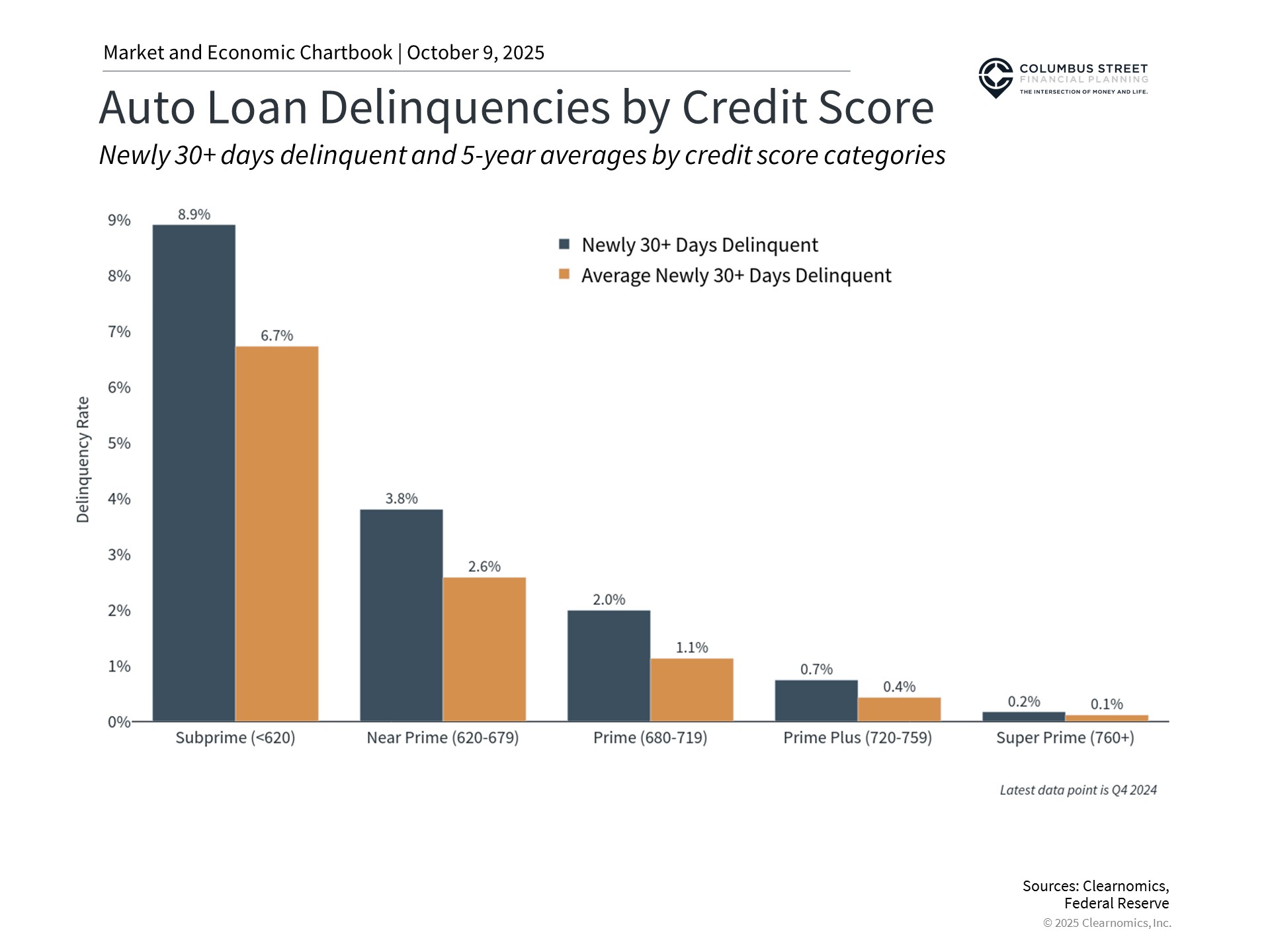

Credit quality drives significant variation in payment delays

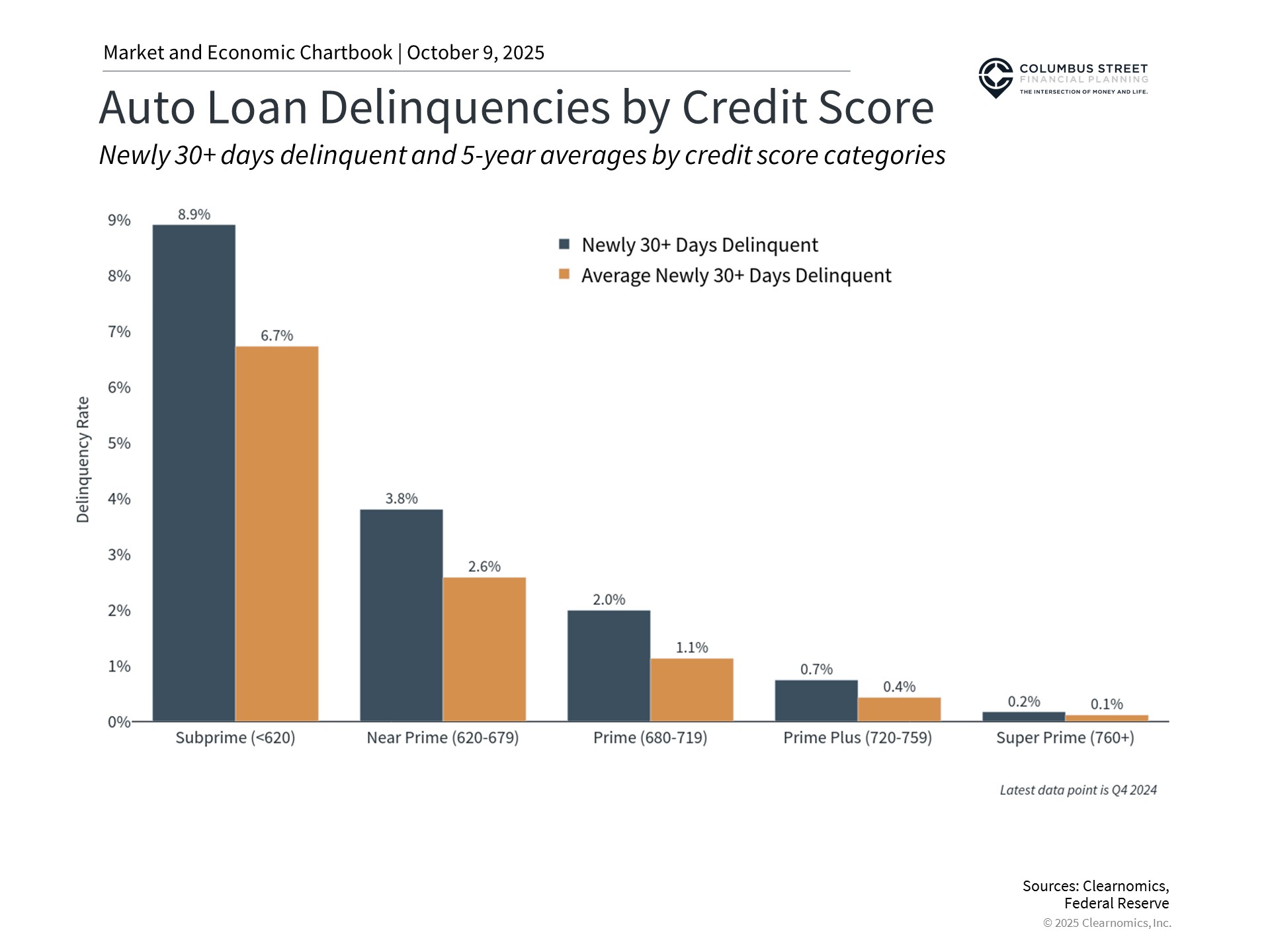

What accounts for increasing delinquency rates and the differences observed across loan categories? Current data indicates that credit quality disparities are the primary driver. Credit quality exists on a continuum, ranging from subprime (individuals with less favorable credit histories) to prime (those with superior credit profiles). Prime borrowers typically represent reduced default risk for lenders, whereas subprime loans frequently carry elevated interest rates reflecting higher repayment uncertainty.

Contemporary statistics reveal that the aggregate increase in auto loan delinquencies stems predominantly from borrowers with diminished credit scores. The accompanying chart illustrates that the gap in delinquency rates between subprime and prime borrowers is substantial in both absolute magnitude and historical context. Similar patterns appear in credit card delinquency data.

This dynamic also clarifies why leading financial institutions have refrained from expressing widespread alarm regarding consumer financial stability. In recent quarterly earnings discussions, banking executives highlighted the ongoing strength of their consumer lending portfolios. This holds true notwithstanding tariff uncertainties, depressed consumer sentiment, elevated inflation worries, and other challenges.

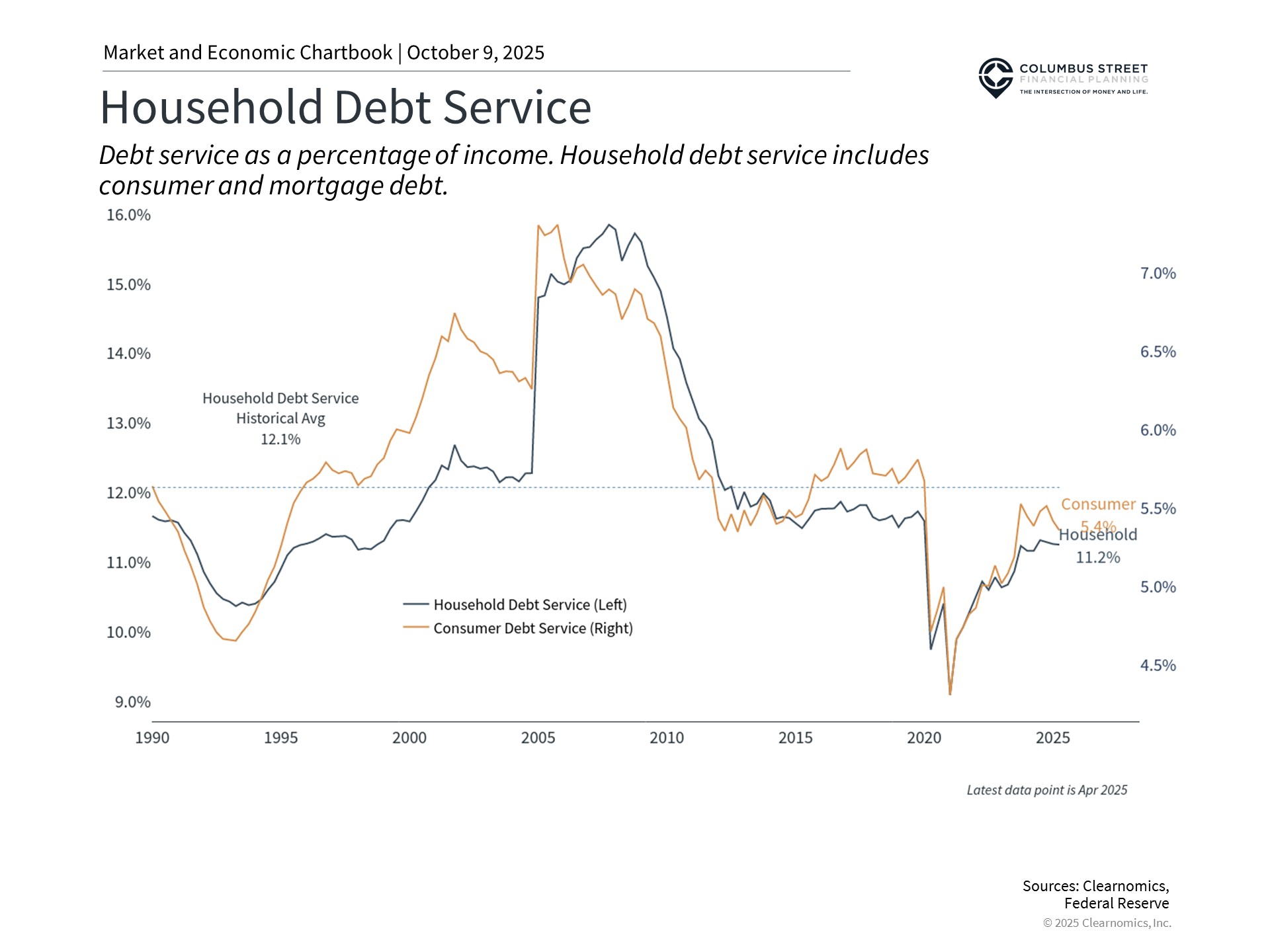

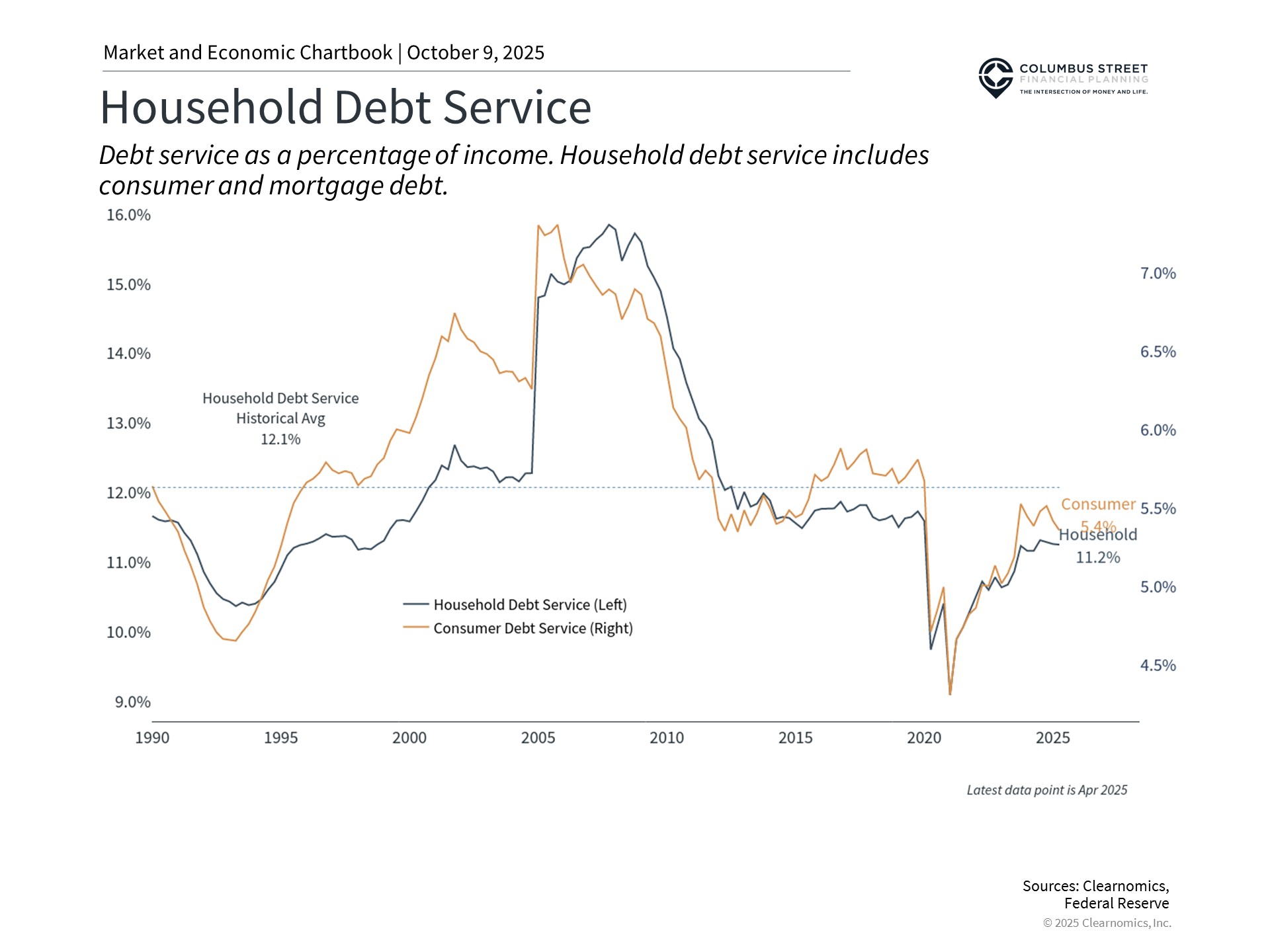

Aggregate debt payment burdens remain sustainable

The fact is that debt levels naturally expand over time alongside economic expansion. Evaluating consumer financial wellness properly requires examining debt relative to income and savings. Currently, the proportion of consumer debt payments to household income sits at 5.5%. Although this measure is trending toward its long-run average, it stays low relative to historical norms. This indicates that typical consumers maintain a healthy capacity to meet their recurring payment obligations.

Likewise, household savings rates have found stability in recent months, with Americans currently setting aside roughly 4.6% of their earnings, though this trails the historical norm of 6.2%. Additionally, U.S. household net worth persists near historic peaks despite recent years’ market turbulence and economic uncertainty. Collectively, these elements establish a solid foundation for consumer financial health across many segments.

Acknowledging that these combined statistics may obscure substantial differences across demographic and economic segments is crucial. The difficulties confronting subprime borrowers within this “two-speed economy” represent genuine and troubling developments. Yet from a macroeconomic and investment market standpoint, the broader measures of consumer finances remain sound.

What are the implications for investors? Although tariffs and market fluctuations have intensified inflation and recession anxieties, aggregate consumer fundamentals continue to demonstrate strength. This benefits investors maintaining portfolios capable of weathering near-term market volatility while markets adjust to economic and policy uncertainties.

The bottom line? The two-speed economy clarifies why aggregate consumer indicators appear robust despite concentrated areas of financial difficulty. Investors should emphasize long-term patterns to maintain investment discipline and accomplish financial objectives.

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein. Clearnomics, “Understanding Consumer Debt in a Two-Speed Economy,” April 2025, www.clearnomics.com