What the Market Correction Means for Long-Term Investors

The author F. Scott Fitzgerald once wrote that “the test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function.” This concept, often referred to as “cognitive dissonance,” is something all investors must grapple with on a regular basis. This is because financial markets can swoon seemingly without reason and, in the worst case, in a way that appears to contradict underlying fundamentals. In these situations, investors can either try to justify these market swings or recognize that they are likely to be temporary. How is this relevant to long-term investors in today’s market and economic environment?

A Small Group of Stocks Has Driven Market Swings This Year

The market recently fell into correction territory, typically defined as a 10% decline from the previous peak, a fact that may seem to be at odds with many measures of strength in the underlying economy. Since the end of July, the S&P 500 has pulled back 10.3% due to concerns around rising interest rates, Fed policy, slow growth in China, political uncertainty in Washington, and more. Even at its recent peak, the market had not fully recovered from last year’s bear market, coming within 4.3% of its all-time high at the start of 2022. Year-to-date, the S&P 500 has still gained 7.2% and the Nasdaq 20.8%.

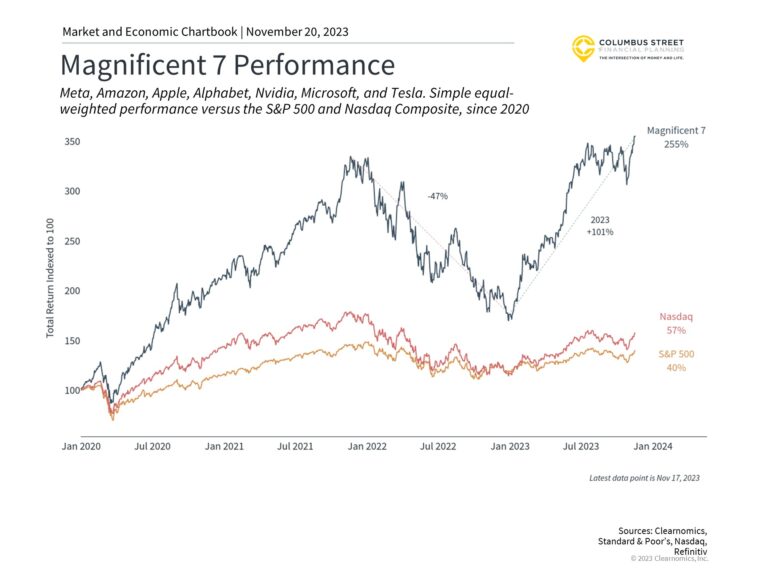

Given these macroeconomic concerns, the biggest contributors to both the up and downs in major indices have been technology stocks. One group of these high-flying stocks is now referred to as the “Magnificent 7” and includes Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia and Tesla. As the chart above shows, this group has gained 77% on average in 2023, contributing significantly to the returns of both the Nasdaq and S&P 500. Over the past five years, they have risen 211% compared to 41% for the Nasdaq and 27% for the S&P 500.

However, despite periods of investor enthusiasm, these stocks are far from a sure thing. Not only have they led declines in the recent market pullback, but they lost nearly half their value during last year’s bear market pullback driven by inflation and Fed rate hikes. Thus, any strong positive gain for this group comes with heightened risk and volatility – just as it does for any risky investment. As is always the case, what matters for long-term investors is how these stocks can contribute to a diversified portfolio, and a broader financial plan, rather than as standalone investments.

One set of opposing forces driving the ups and downs in tech are enthusiasm for new technologies such as artificial intelligence on the one hand and higher interest rates on the other. When interest rates rise, the value of money promised to you far into the future is suddenly worth less. Another way to understand this is that, when rates rise, you have more attractive ways to invest your money. This can impact technology stocks more than other sectors since they depend on the promise of cutting-edge innovation and commercialization that may be years or even decades away. Not only have interest rates risen, but with the 10-year Treasury yield briefly exceeding 5%, they are at levels not seen since 2007. Unfortunately, this has dragged the overall market lower.

The Economy is Far Stronger Than Anticipated

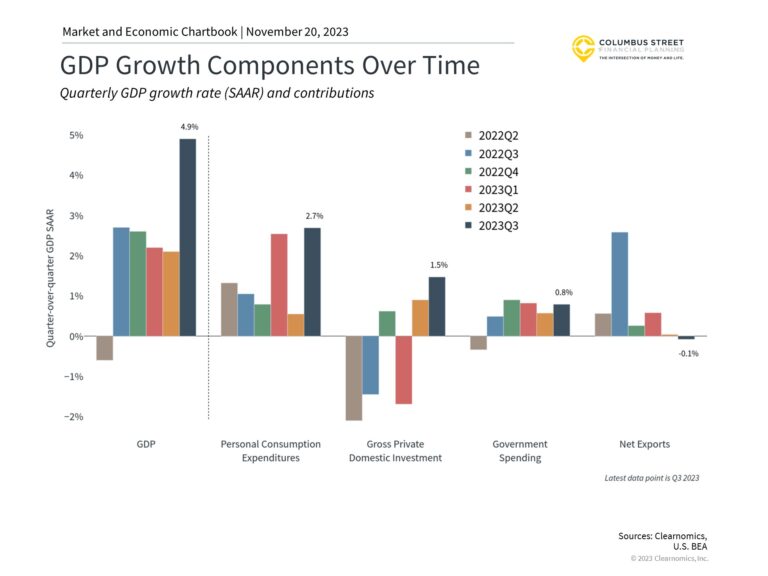

What may drive cognitive dissonance for some investors is that these market moves are happening at a time when the economy is far stronger than previously believed. The latest GDP report for the third quarter was significantly better than economists had expected just a few months earlier. Not only did the economy grow 4.9% at a quarter-over-quarter annualized rate, after accounting for inflation, but growth was also broad across consumer purchases of goods and services, business investment, and government spending.

In fact, this was the best quarterly GDP number since 2021 when the economy surged after the pandemic. Growth rates this strong have only occurred a few times over the past two decades – prior to 2021, it last occurred in 2014, and before that in 2006. That said, some investors are naturally concerned that this may not continue and that a recession is still possible if rates remain elevated and if the Fed does tighten further. There are also worries that consumer spending may decelerate as households draw down their excess savings and private investment could slow as a buildup of business inventory reverses.

Still, it’s undeniable that the economy has been far stronger than economists expected. While it is still early, consensus expectations are for the economy to grow 0.8% in the fourth quarter while the Atlanta Fed’s GDPNow model is forecasting 2.3%. Either way, this year has shaped up far better than many had feared, especially because inflation continues to improve toward the Fed’s long-run target and the labor market remains strong. If you had told an investor a year ago that conditions would be this positive, they most likely would have guessed that we would be in the midst of a new bull market.

Market Corrections Occur Regularly

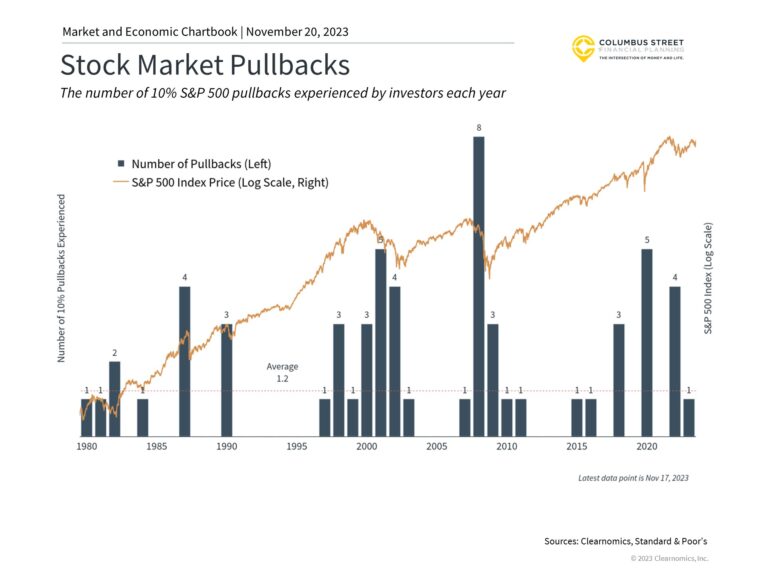

So, what are investors to do when markets swoon despite strong fundamentals? The chart above is a reminder that market corrections occur on a regular basis, in both good and bad years, and even during strong bull markets. When corrections do occur, markets often fall as much as 14% or more. Despite this, major indices have historically recovered in a few months.

What’s more important is that rebounds often occur suddenly and unexpectedly, just as they did in mid-2020, earlier this year after the banking crisis, and throughout countless other examples. Trying to time this reversal perfectly often backfires since it means missing out on the earliest part of a recovery. Of course, the past is no guarantee of the future, but this a reminder for investors to stay focused on the long run and not get caught up in short-term market movements.

The bottom line? The market recently fell into correction territory despite many signs of economic strength. Investors should continue to focus on the big picture trends rather than react to daily market moves.

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein.