Abrupt and cascading market sell-offs are uncomfortable even for the most seasoned long-term investors. The continuing tragic loss of life and expected economic fallout from COVID-19 has reminded us all there are only certain things in life in our control; which, incidentally, are the same things we could control before the pandemic and at no point included what the market would do next.

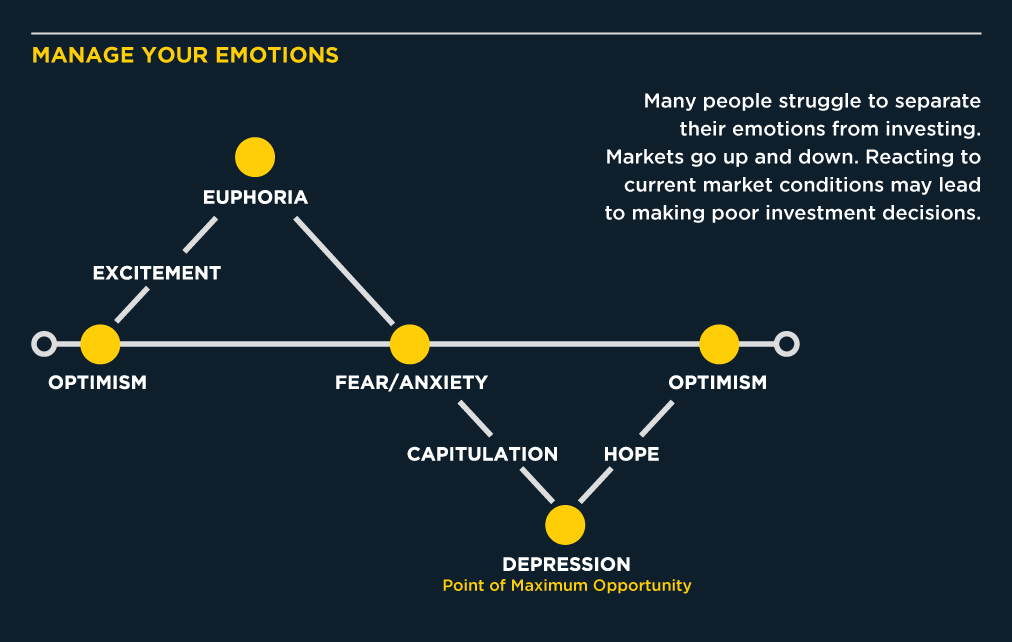

The Cycle of Market Emotions illustrates our human responses to market gyrations. As witnessed in the 2008 Global Financial Crisis and now again in the COVID-19 Pandemic of 2020, the path from euphoria to depression can be an exceedingly short distance.

5 Actions to Consider Now

Fear, anxiety, and capitulation are all rational and understandable human responses to the current environment. And that is precisely why your long-term plan – the one customized to your situation and created around your goals and values – anticipates and prepares for such unforeseeable events. Here are five actionable steps to you can take to improve you and your family’s odds of achieving long-term success.

1. Increase Retirement Plan Contributions

For individuals still in the workforce, increasing the amount you put into your 401(k) account or equivalent plan may be a prudent move. Lower equity valuations provide an opportunity to buy more shares at a cheaper price relative to just a few months ago. Increasing your savings amount in such environments can have a positive impact on your long-term wealth. In addition, consider making post-tax Roth 401(k) contributions if your employer plan allows.

2. Advance 529 Plan Contributions

Do you have kiddos still five or more years away from entering college and needing to make tuition payments? If so, right now may be a good time to advance future years’ contributions and take advantage of current equity valuations. Growth in 529 plan is tax-deferred and tax-free if its funds are used to pay for qualified education expenses. Based on your state of domicile, your contributions may be state tax deductible. Ohio allows up to a $4,000 annual tax deduction per 529 plan beneficiary and allows contributions over the aforementioned amount to be carried forward to future year tax filings.

3. Harvest Taxable Losses

Tax swapping is the sale of an investment currently at a loss, and the simultaneous purchase of a similar investment but not identical. The strategy realizes a tax-deductible loss against future gains and still maintains the structural integrity of your investment portfolio. There are several factors such as the availability of other suitable options and transaction costs that should be considered in determining whether this strategy is appropriate for your individual circumstances. In addition, now is a great time to review your “asset location” across your various long-term retirement and taxable investment accounts. Do you have the right investments in the optimal account given the taxable attribute of the account? Increasing the tax efficiency of your investment portfolio is key in reducing “tax drag” on investment returns, especially investments in a taxable portfolio.

4. Portfolio Rebalancing (with caution)

Portfolio rebalancing should typically be performed on an annual basis. With the recent volatility, a typical portfolio allocated to 60% stocks and 40% bonds may now be a 50/50 portfolio based on recent downward volatility. Rebalancing in this scenario increases the investments in your portfolio that are now relatively less expensive and have a higher future expected rate of return. In addition, rebalancing across the spectrum of equity investments such as US stocks, International stocks, and Emerging Market stocks is just as important in building long-term wealth.

5. Roth Conversion

Have a traditional IRA or an old 401(k) you have never rolled over? Now may be an excellent time to evaluate if converting pre-tax retirement assets to post-tax Roth IRA assets is right for you. During retirement, post-tax (traditional 401(k)/IRA/SIMPLE/SEP) assets when withdrawn will be tax at your income tax rates and subject to required distributions by the IRA when you turn age 72. With Roth, withdrawals are tax-free when distributed and are not subject to mandatory distribution rules. Managing and optimizing your current income tax bracket through Roth conversion can be a great tool to potentially increase your long-term wealth. A Roth conversion strategy should always be customized to your specific tax situation in tandem with your long-term goals.

Having a plan means staying the course during extreme market volatility in the short-term and involves taking advantage of important wealth-building opportunities that present in times of uncertainty. There is an old saying “wealth is created in Bear markets, but not realized until Bull markets.” The current state of fear and capitulation will soon give way to hope and optimism, and thus the market cycle begins anew.

As always, your questions or comment is welcomed. Please be in touch at shawn@columbusstreetfin.com.

Important disclosure: The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each individual should seek independent advice from a tax professional based on his or her individual circumstances. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice.

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein.