When it comes to maintaining and optimizing your portfolio for your long-term financial goals, there are many behaviors to think about. One of those behaviors is to rebalance your portfolio.

Why is ongoing maintenance so critical? Think about the last time you bought a new car, truck, or motorcycle. During your tour, you likely noticed the machine’s quality—the way it ran, the polished features, and how it made you feel.

But after you drive off of the lot, it won’t simply retain the fresh scent, smooth drive, and perfect shine forever. It takes consistent effort and maintenance to prolong the vehicle’s life and keep it running properly for years to come.

The same idea is true for your portfolio. How can consistent rebalancing impact your investments? Let’s find out.

What Is Portfolio Rebalancing?

Portfolio rebalancing is all about maintaining your desired asset allocation and risk preferences to best achieve your long-term goals. Rebalancing can also be thought of as a forced mechanism to sell when prices are high and buy when prices are low. Below is an example to help illustrate this point.

Sample Portfolio

Let’s say that your long-term asset allocation target is 70% Stocks (Equities) and 30% Bonds (Fixed Income). This is all based on your risk tolerance, risk capacity, time-horizon, and financial goals. Please note that for this example, we’ll just focus on stocks and bonds (as opposed to diving into specific sub-asset classes—something we’ll discuss later on).

Given the long-term target, the goal is to maintain this asset allocation within your portfolio. It’s critical not to veer too far off these targets as the markets go up and down (which they always do). If stocks go on a tear and bonds drop drastically, you might find your allocations shift to 80% stocks and 20% bonds.

In this case, some action or behavior must be done to help bring your overall portfolio asset allocation back to your long-term target, a.k.a rebalancing your portfolio.

How to Take It to The Next Level

Research also shows that rebalancing between equity asset classes provides the potential for improved long-term performance. In the example above, we were simply talking about rebalancing between broad equities and broad fixed income. However, in practice, the act of rebalancing can be done within sub-asset classes.

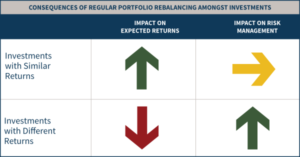

For example, with equities, you can rebalance between U.S. Large Cap, U.S. Mid-Cap, U.S. Small-Cap, International Developed, International Emerging, etc. What this research shows is that there is a long-term performance bonus from rebalancing between equity asset classes. Rebalancing among several asset classes has an impact on the associated risk.

Take a look at this chart from Michael Kitces.

Employing more diversity in your rebalancing strategy could aid both in returns and overall risk management.

This is essential because diversification and rebalancing tend to focus more on optimizing the risk-reward tradeoff, as opposed to solely optimizing for performance.

Why Does Rebalancing Matter?

An Investment Policy Statement (IPS) is a key document when rebalancing. All this means is that you have an agreed-upon investment policy that states your long-term allocation targets.

An IPS also outlines when it makes sense to rebalance. For example, it could state that if your allocation to any asset class goes above (or below) 5% from the target, we ought to rebalance the portfolio.

Because asset classes behave differently and independently to market conditions, it’s critical to stay on top of those shifts. Ultimately, you want to ensure that your portfolio continues to operate in the way that you and your advisor designed it.

Even if you do not have an IPS, rebalancing is vital to make sure that your overall portfolio is aligned with your long-term goals and risk preferences. It’s our mission at Columbus Street to work collaboratively with you in a fiduciary capacity to build and maintain your portfolios over time.

Strategies to Rebalance Your Investments

Rebalancing isn’t just about swapping assets, it must also take the tax consequences of those actions into account.

You want to rebalance in the most tax-optimized way. How does that work? Start by rebalancing in the most tax-efficient accounts like tax-deferred or exempt (401k and Roth IRA). These accounts have the lowest tax-friction when selling assets.

Why would you avoid starting with taxable accounts? You’re taxed in the year any transactions happen, which could trigger unnecessary tax burdens. Be sure to watch out for sales that would yield short-term capital gains (assets held less than a year) as the taxes are higher than long-term gain.

While rebalancing, you want to take a birdseye view of all your investment accounts such as 401(k)’s, IRA’s, other retirement accounts, and taxable accounts. Sometimes that’s hard to do, especially if you’re married (more accounts to manage and more financial institutions).

Either way, it’s still important to make sure that you can see your portfolio in aggregate to best assess your allocations and rebalancing status.

How Often Should You Rebalance Your Portfolio?

In most cases, you should rebalance your portfolio with a systematized and consistent cadence. Depending on your unique financial plan, you could rebalance quarterly, semi-annually, or just yearly.

However, be cognizant of the following:

- Market volatility

- Risk preferences.

It doesn’t take a lot for allocations to drift, especially if the markets are volatile. Simply, this presents an opportunity to sell high and buy low.

However, exercise caution about rebalancing too quickly in periods of extreme volatility. Doing so could mean a lower basis in your taxable accounts and increased capital gain exposure long-term.

When risk preferences change or if a life event occurs, it may make sense to rebalance your portfolio more often than your typical “schedule”.

The key to figuring out a frequency that’s right for you comes down to two elements:

- Taxes

- Fees

Consider our top three takeaways when it comes to rebalancing.

- Prioritize tax-efficiency by considering asset location, ensuring that any trades (where possible) are some in tax-deferred or tax-exempt accounts.

- When rebalancing in taxable accounts, put long-term gains first.

- Rebalance with as few trades as possible to limit trading or transaction fees.

Prioritize Long-Term Investment Health

Maintaining and optimizing your portfolio is critical for reaching your long-term financial goals. Portfolio rebalancing is one of those tools that will help make that possible. It’s a practice that aims to optimize the risk-reward tradeoff based on your specific preferences and goals.

While the key points discussed above can get confusing, we are always here to help. We’re passionate about helping you build strategic portfolios designed for the long haul.

Would you like to see if your allocations are aligned with your goals? Schedule a call with us today!

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein.