The well-known investment maxim “don’t fight the Fed” has proven its worth since emerging in the 1970s, becoming increasingly relevant in today’s complex financial landscape. This principle emphasizes that Federal Reserve monetary policy shifts can significantly influence both markets and economic conditions, making them crucial considerations for investors. However, successful investing requires focusing on the broader trajectory of interest rate policy rather than getting caught up in individual Federal Reserve announcements. This perspective is particularly valuable as the Fed navigates its ongoing rate reduction cycle within today’s intricate economic backdrop.

The September Rate Decision: Context and Implications

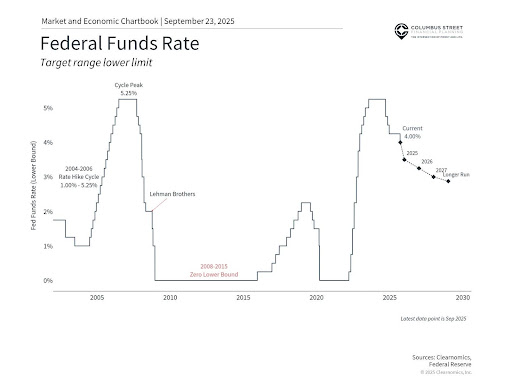

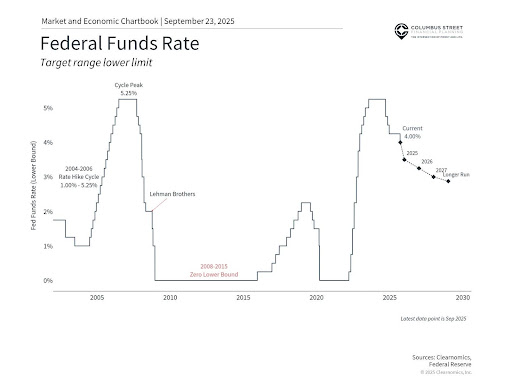

The Federal Reserve delivered an anticipated 0.25% rate reduction at its September meeting, extending the monetary easing campaign that commenced in 2024. This decision unfolded against a backdrop of near-record market valuations, conflicting economic indicators, and persistent questions surrounding trade policy and price pressures. What distinguishes today’s rate adjustments from previous cycles is their measured, preventive nature rather than crisis-driven urgency. Unlike the dramatic emergency interventions witnessed during the 2008 financial meltdown or the 2020 pandemic response, current policy moves represent careful calibration aimed at preserving economic momentum.

For investors with long-term horizons, grasping the rationale behind current Fed actions and recognizing how today’s environment differs from historical precedents offers valuable insight for strategic planning and portfolio management. While rate reductions typically provide market support, success depends on maintaining proper perspective and remaining committed to long-term objectives rather than reacting impulsively to each policy adjustment.

The “Why” Behind Rate Cuts Trumps Timing and Magnitude

“Why” the Fed is cutting rates matters more than “when” or “how much”

Federal Reserve policymakers base their decisions on comprehensive analysis of economic indicators spanning growth metrics, employment data, and inflation trends to develop forward-looking assessments. When economic prospects remain unclear, disagreement naturally emerges among Fed officials and economic experts, leading to varying opinions on the timing and scale of future rate adjustments. This scenario characterizes today’s environment, with significant divergence visible in officials’ rate projections. While media attention often centers on political tensions between the Fed and administration, the reality is that such disagreement has been persistent throughout this cycle.

Several key points merit consideration despite these differing viewpoints. The Fed has long anticipated implementing rate reductions, with recent Summary of Economic Projections consistently indicating cuts would likely begin this year, even as specific numbers and timing have fluctuated based on trade policy developments and market volatility. Current Fed projections suggest two additional reductions may occur this year, supported by an enhanced growth outlook.

Additionally, today’s rate cuts differ fundamentally from historical easing cycles typically triggered by emergencies. Current reductions continue reversing the aggressive rate increases implemented to combat inflation beginning in 2022. These cuts occur amid moderating but still positive economic conditions, despite potentially weakening employment data and more persistent inflation than desired. In essence, the Fed’s quarter-point reduction to support economic steering differs markedly from substantial emergency cuts responding to financial system problems or economic crises.

Looking ahead, Fed Chair Jerome Powell’s term likely concludes in May 2026, with President Trump appointing the next governor. This transition suggests the federal funds rate will probably trend lower. While short-term interest rates may follow this downward trajectory, long-term rates respond primarily to market and economic forces rather than Fed policy. For instance, if lower short-term rates stimulate higher inflation, long-term rates might paradoxically increase.

Therefore, while this rate cut continues the Fed’s 2024 trajectory rather than marking a directional shift, it demonstrates the Fed’s dedication to supporting economic expansion.

Mixed Economic Signals Create Policy Challenges

Recent economic data has been mixed

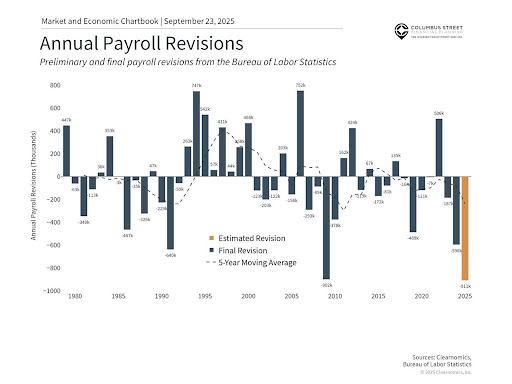

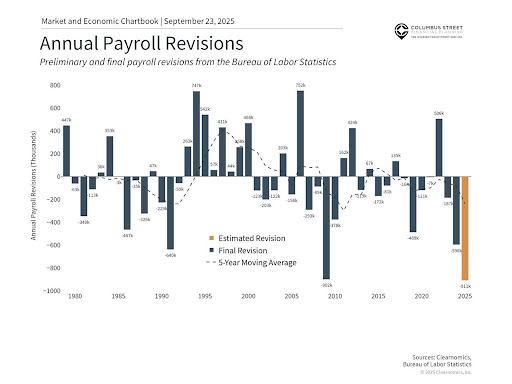

Labor market softening primarily motivated the Fed’s decision. August job creation totaled just 22,000 positions, substantially below forecasts, with significant downward revisions to previous months. However, unemployment rose only to 4.3% due to fewer job seekers. Again, this differs from past emergency cutting periods. During the 2008 crisis, unemployment surged from 5.0% to 10.0%, while in 2020 it jumped from 3.5% to 14.8%. Current employment figures suggest gradual cooling that may reflect moderating labor market conditions.

Recent payroll revisions intensify labor market concerns, revealing a more subdued employment picture than earlier data suggested. The Bureau of Labor Statistics’ annual revision process indicated 911,000 fewer jobs were created between March 2024 and March 2025, suggesting faster labor market cooling than policymakers recognized when making previous monetary policy decisions. These preliminary estimates await finalization in early 2026.

While weakening employment supports rate reductions, Fed inflation concerns favor maintaining steady rates or even increases if trade policies drive prices higher. The Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) Price Index, remains at 2.6%, well above the 2% target. Core PCE hovers at 2.9%, while headline and core CPI persist at 2.9% and 3.1%, respectively. Earlier inflation progress has not only stalled but partially reversed recently.

The Fed must balance these factors within its “dual mandate.” The conflicting signals from these indicators explain disagreement both within the Fed and with the administration. For investors, understanding these trends will likely prove more valuable for comprehending the economic and interest rate environment than following daily political headlines.

Rate Reductions Typically Support Markets and Business Activity

For investors, the crucial distinction involves whether rate cuts accompany recession or support continued growth. While some economic weakness indicators exist, recession signs remain absent. In such circumstances, rate reductions typically provide broad financial market benefits. Reduced borrowing costs enable companies to finance growth more affordably and decrease debt service expenses. Consumer spending may increase as mortgage and credit rates decline, boosting demand for products and services.

One contemporary concern involves rate cuts occurring near stock market record highs. While atypical, historical precedents exist. Under Alan Greenspan, the Fed implemented three cuts during 1995 and 1996, labeling them “insurance” against economic slowdown. The Fed also cut rates in 2019 near market peaks to address global growth concerns. At the recent press conference, Powell characterized this latest policy decision as “a risk management cut” based on the Fed’s assessment that “downside employment risks have increased.”

Historically, rate cuts generate generally positive portfolio effects across asset classes. While past performance doesn’t guarantee future results, equities typically benefit as lower rates reduce future earnings discount rates and improve corporate profitability, particularly for growth-focused companies. Bonds usually gain value due to their higher yields, though this varies across sectors and maturities. Conversely, cash will likely experience reduced yields, making it less attractive compared to investments like stocks and bonds.

While each economic cycle presents unique characteristics, managing policy changes represents a normal investment aspect. Importantly, rate cuts generally support long-term investors, though balancing risk and reward requires comprehensive market trend understanding.

Key Takeaway

The Fed’s recent rate reduction may support economic conditions amid mixed signals. Investors should maintain long-term perspectives, concentrating on overall market direction rather than individual Fed decisions.

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein. Clearnomics, “Special Insight: What the Fed-Rate Cut Means for Long-Term Investors,” September 2025, www.clearnomics.com