The Significance of the great wealth transfer

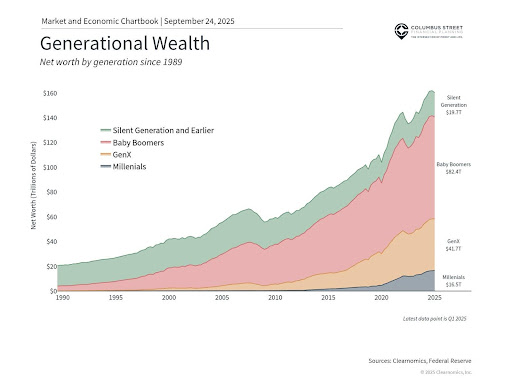

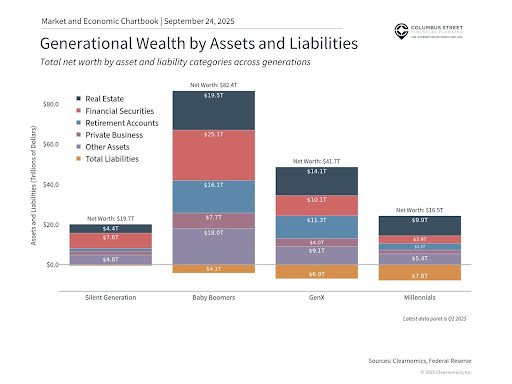

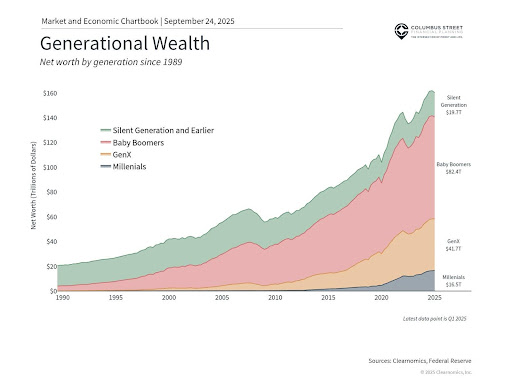

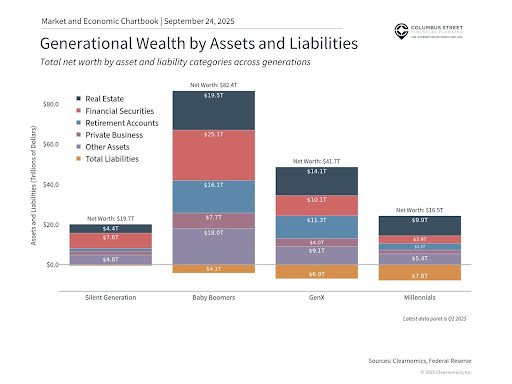

Wealth transfer magnitude and composition have transformed significantly in recent decades. Today’s retirees have built considerable assets through retirement accounts and investment portfolios, departing from earlier generations who depended mainly on pensions and Social Security. Baby Boomers, currently aged 61 to 79 in 2025, possess more than $82 trillion in wealth based on Federal Reserve data.

This wealth accumulation reflects structural changes, including extended lifespans, sustained financial market growth, and the widespread shift from defined benefit pension systems to retirement vehicles like 401(k)s and individual retirement accounts (IRAs). Although this transition increased individual retirement savings responsibility, it simultaneously generated larger investable asset pools destined for heirs. Consequently, more families face substantial wealth transfer planning than ever before.

Securing Lasting Legacies through wealth transfer planning

You can deduct up to $25,000 for singles ($50,000 for married couples) in qualified tips, but your actual savings depend on your tax bracket. A server in the 12% bracket earning $8,000 in tips saves only $960 in federal taxes. More importantly, you’ll still owe the full 7.65% in FICA taxes on those tips, and the deduction phases out for higher earners.

The critical nature of this planning stems from these assets representing decades of methodical saving and investment discipline. Contemporary wealth transfers typically encompass diversified investment portfolios, multiple retirement accounts, and various tax-advantaged savings instruments. Combined with inherited real estate or family enterprises from previous generations, each component demands meticulous planning to ensure seamless transitions and optimal tax efficiency.

Therefore, estate planning has become more crucial than previously. Although many view estate planning as establishing wills and related documents such as durable powers of attorney and advance healthcare directives, comprehensive wealth transfer extends beyond simple asset allocation. Through considering how your wealth can generate meaningful impact, optimizing taxation, and managing complex or illiquid structures, investors can establish enduring legacies.

Significantly, while individual asset bases and legacy goals vary, underlying principles remain consistent. Similar to how Maslow’s hierarchy of needs explains human motivation – where fundamental needs like food and shelter require fulfillment before pursuing higher aspirations – comparable progression applies to wealth planning. After establishing adequate retirement savings for basic requirements, attention can turn toward creating meaningful wealth impact.

Remember that numerous wealth transfer conflicts stem not from inadequate assets, but from complicated structures, ambiguous intentions, or insufficient heir preparation. Comprehensive wealth transfer strategies should incorporate values, expectations, and financial accountability to facilitate smoother transitions.

Optimizing wealth transfer strategies

Regarding practical approaches, critical decisions in wealth transfer optimization involve timing and taxation considerations. Consider these impactful strategies:

1. Tax-Efficient Lifetime Giving

Lifetime giving suits only certain situations, requiring confidence that gifted assets won’t be needed for personal retirement security, particularly given rising healthcare costs and extended life expectancies.

However, annual gift tax exclusions permit individuals to transfer up to $19,000 per recipient in 2025 without affecting lifetime estate tax exemptions. Lifetime giving offers practical advantages beyond tax benefits. You can observe recipient money management, provide financial guidance, and witness your generosity’s positive effects.

For charitable giving enthusiasts, donor-advised fund contributions provide substantial tax benefits, while including family members in philanthropic decisions helps transmit values alongside wealth.

2. Multigenerational Education Funding

Educational investment provides young family members with essential tools and knowledge for building successful futures. This becomes particularly meaningful considering college costs have dramatically exceeded inflation rates recently, making educational assistance tremendously valuable.

Unlike other gifts, direct tuition payments to educational institutions don’t count toward annual gift tax exclusions, creating especially tax-efficient wealth transfer opportunities. Furthermore, 529 education savings plan contributions offer unique legacy planning advantages, allowing substantial contributions while maintaining account control. 529 plans cover K-12 tuition, college expenses, and student loan repayments.

For extensive families with numerous grandchildren or great-grandchildren, education trusts merit consideration. Although education trusts increase complexity, they can ensure fair treatment across beneficiaries, supporting multigenerational family members while creating lasting legacies.

3. Asset Location Strategies

Asset location involves strategically positioning investments across different account types – taxable, tax-deferred, and tax-free – to maximize results.

Through thoughtful financial structure consideration and mapping specific assets to particular bequests, you can ensure optimal outcomes for yourself and beneficiaries. Techniques like tax-loss harvesting can minimize tax implications.

For instance, substantial unrealized capital gains in taxable accounts present options for reducing tax burdens. This might include waiting until death for cost basis “step-up,” or potentially gifting assets to charity gradually. Thoughtful gifting could provide dual benefits of immediate tax deductions while avoiding gain realization taxes.

4. Advanced Estate Planning

As wealth transfer amounts grow and tax implications become more intricate, sophisticated estate planning techniques become increasingly valuable.

This may involve trusts distributing assets over time, including specific provisions or charitable components engaging next generations. Modern wealth transfer complexity extends to business interests, retirement account beneficiary designations, and coordination between various liquid and illiquid assets.

These strategies require specialized expertise to ensure optimal results and prevent unintended consequences. Nevertheless, opportunities for supporting future generations have never been more promising.

The bottom line? The Great Wealth Transfer creates an unprecedented opportunity for generating lasting multigenerational impact. Whether preparing wealth transfers or anticipating inheritance, strategic planning helps ensure family financial legacies fulfill their intended objectives.

Important Disclosure: All Content is information of a general nature and does not address the circumstances of any particular individual or entity. This Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice as a specific recommendation or specific endorsement by Columbus Street. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. Columbus Street accepts no responsibility for loss arising from the use of the information contained herein. In exchange for using this Content, you agree not to hold Columbus Street liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you. You alone assume the sole responsibility of evaluating the merits and risks associated with using any information or other Content provided by Columbus Street before making any decisions based on such information or other Content. You should consult with your tax advisor and financial professional before making any determination as to the appropriateness of any planning strategy indicated herein. Clearnomics, “How The Great Wealth Transfer Creates Financial Planning Opportunities,” September 2025, www.clearnomics.com