The 2024 presidential election is approaching, and as a financial advisor, I’m hearing a common concern from both clients and the broader investment community: “How will the election affect my portfolio?” With polls showing a tight race between former President Donald Trump and Vice President Kamala Harris, it’s natural to feel uncertain about the market’s direction.

Let me offer some perspective that might help you sleep better at night, regardless of your political leanings.

The Market Doesn’t Play Politics

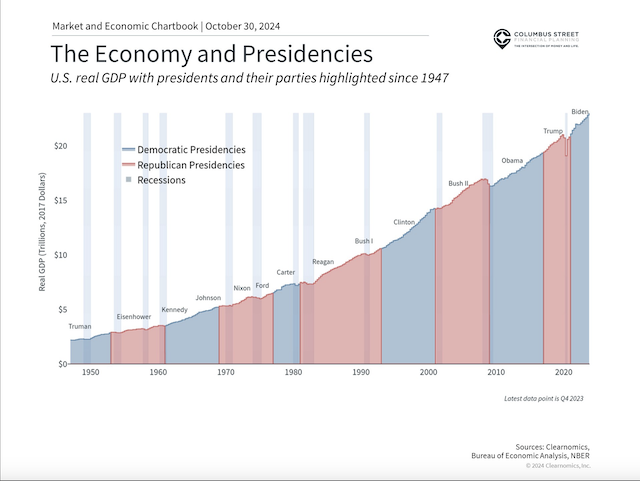

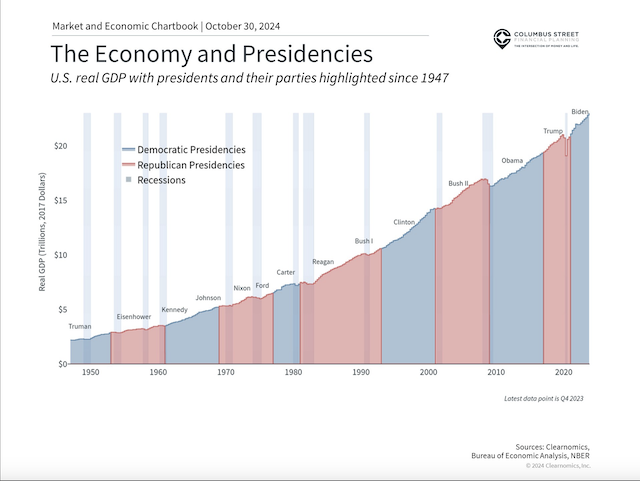

The economy has grown under both major parties.

One of the most important lessons from decades of market data is surprisingly straightforward: the economy and markets have historically grown under both major political parties. While this might seem counterintuitive, especially given today’s heated political climate, the reality is that markets are driven by factors far more fundamental than who occupies the White House.

Think about the forces shaping our economy right now:

– Artificial intelligence and technological advancement

– Shifting workforce dynamics

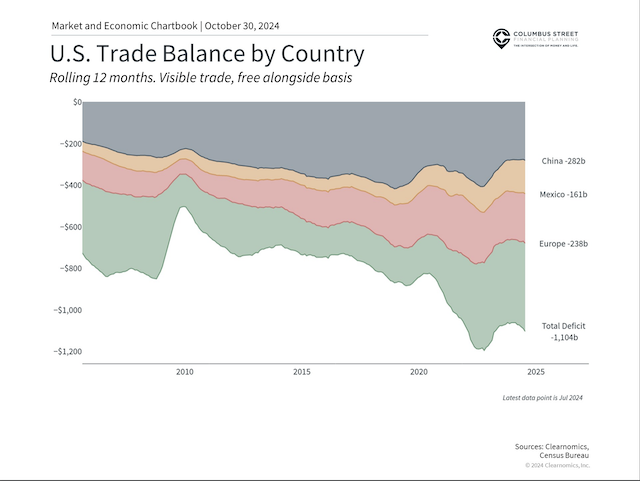

– Global trade relationships

– Innovation in key industries

These powerful trends continue regardless of election outcomes.

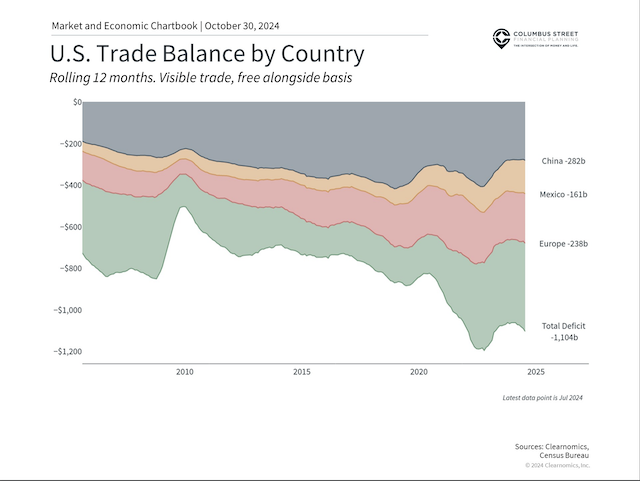

Global trade and tariffs will depend on the election.

Understanding Tax Policy Impact

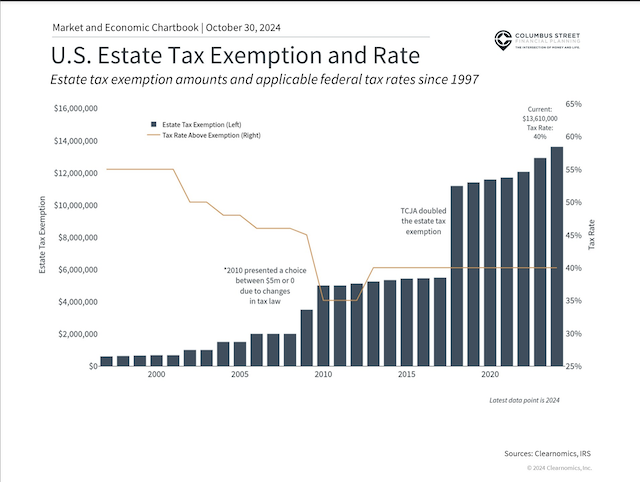

Looking ahead, tax policy remains a key area of focus for investors. The Tax Cuts and Jobs Act (TCJA) sunset in 2025 creates what some call a “tax cliff,” leading to uncertainty about future individual and corporate tax rates.

However, it’s crucial to maintain perspective. Current tax rates are relatively low by historical standards, and this will remain true regardless of modest adjustments to top marginal rates. While tax policy certainly matters for individual financial planning, its impact on overall market performance is often overstated.

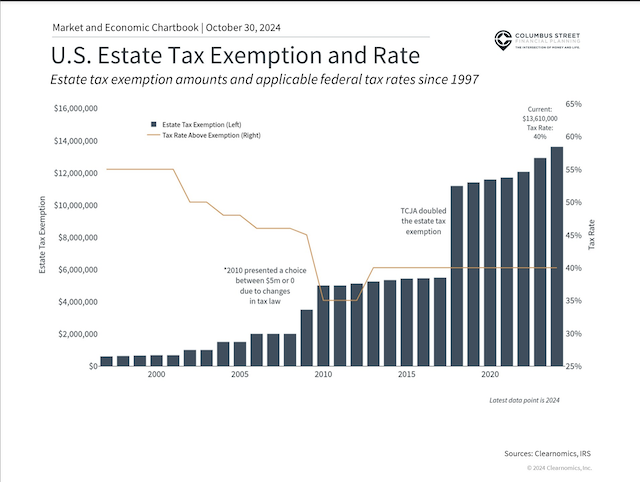

Estate Tax Planning Considerations

Estate planning deserves special attention in 2024. The current estate tax exemption of $13.6 million could potentially be reduced to approximately $6.8 million per individual in 2026. This potential change makes proactive estate planning increasingly important for affected families.

Tax policy is uncertain, especially relating to estate planning.

Trade Policy and Market Impact

Trade policy, particularly regarding tariffs, represents another area where the candidates differ. However, recent history offers an instructive lesson. The significant tariffs implemented during the Trump administration largely continued through the Biden presidency, demonstrating how trade policy often transcends partisan lines.

Moreover, markets have shown remarkable resilience to trade tensions. Remember the trade war fears of 2018-2019? While markets experienced volatility, the worst-case scenarios many predicted didn’t materialize. Instead, the economy remained robust, with low unemployment and stable inflation rates.

Why Markets Care Less About Elections Than You Might Think

Several factors explain why elections often have less market impact than expected:

- Policy Implementation Takes Time: Campaign promises face a long road to becoming policy, thanks to our system of checks and balances.

- Markets Are Forward-Looking: By the time an election occurs, markets have typically priced in various potential outcomes.

- Corporate Adaptability: Companies have proven remarkably adaptable to different political environments, often finding ways to succeed regardless of policy changes.

- Global Factors: In our interconnected world, domestic politics are just one of many factors influencing market performance.

Smart Investment Strategies for Election Season

As we navigate through this election year, here are key principles to remember:

- Stay Focused on Long-Term Goals: Your investment strategy should be built around your personal objectives, not election cycles.

- Avoid Emotional Decisions: Making portfolio changes based on political predictions rarely leads to better outcomes.

- Maintain Proper Diversification: A well-diversified portfolio remains one of the best defenses against policy uncertainty.

- Consider Tax Planning: While tax policy may change, tax-efficient investing strategies remain valuable across administrations.

Looking Beyond November

While the upcoming election is undoubtedly significant for many aspects of American life, its impact on your investment portfolio may be less dramatic than headlines suggest. History shows that patient investors who stick to their long-term strategies tend to fare better than those who make reactive decisions based on political outcomes.

Remember, the vote that truly matters for your portfolio isn’t cast at the ballot box—it’s cast every time you make a thoughtful, disciplined investment decision aligned with your long-term goals.

*This article is for informational purposes only and should not be considered as specific investment advice. Consult with qualified professionals regarding your individual circumstances.*

——

*Shawn Ballinger is the founder of Columbus Street Financial Planning, specializing in helping individuals and families achieve their long-term financial goals through comprehensive financial planning and investment management.*