1. Key Changes in the Final Regulations:

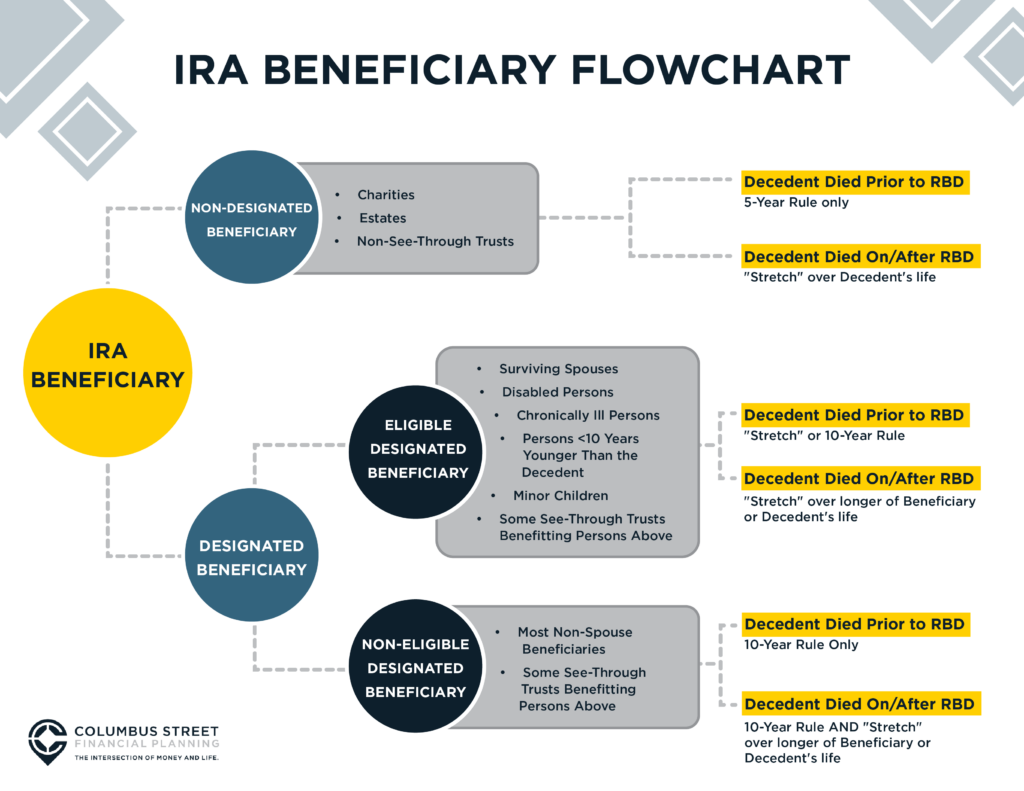

Clarification of 10-Year Rule for Post-Death Distribution Rules for Non-Eligible Designated Beneficiaries:

– If death occurred before RBD (required beginning date, or effectively RMD age): Beneficiary only needs to empty the account by the end of the 10th year after death.

– If death occurred on or after RBD: Beneficiary must take annual RMDs in years 1-9 AND empty the account by the end of the 10th year. However, the IRS has ruled no RMDs are required for 2024!

2. Trust Beneficiaries:

– New definitions clarify which trust beneficiaries are considered beneficiaries of the retirement account.

– Trusts that divide into separate sub-trusts upon the account owner’s death can apply RMD rules individually to each beneficiary.

3. Annuities in Retirement Accounts:

– Annuity payments can now count against RMDs for non-annuity assets in both employer plans and IRAs. This is a victory with those receiving a stream of Qualified (IRA) annuity payments.

– Post-death annuity payments must cease by the date the account is required to be fully distributed.

Important Points from the Proposed Regulations

1. RMD age clarification for IRA account holders:

Birth Year before1950 or earlier, RMD age is 72 (or 70 ½ who turned 70 ½ prior to 2020).

Born between 1951-1959, RMD age is 73.

Born in 1960 or later, RMD age is 75.

2. Distributions from Designated Roth accounts do not count towards RMDs.

The Final Regulations introduce a strict rule for Designated Roth Accounts:

Benefit: Non-Eligible Designated Beneficiaries are exempt from annual RMDs during the 10-Year Rule period.

Condition: This benefit applies only if 100% of the plan balance is in a Designated Roth Account.

Exception: If any amount, even $1, remains in the Traditional portion of the plan (e.g., Traditional 401(k) or 403(b)), AND the account owner died after their Required Beginning Date (RBD), THEN the Designated Roth account funds become subject to annual distributions during the 10-Year Rule period.

This all-or-nothing approach in the regulations significantly impacts retirement and estate planning strategies, particularly for individuals with mixed Traditional and Roth balances in their retirement plans.

3. New rules for surviving spouses electing to be treated as the deceased employee:

– Election is automatic in some cases, but not all.

– RMDs start when the original owner would have begun distributions.

– No “Stretch” treatment for beneficiaries after the surviving spouse’s death.

4. Trust Beneficiaries:

The regulations provide clarity on which trust beneficiaries are considered beneficiaries of the retirement account:

– For Conduit Trusts: Only the initial beneficiary is considered.

– For Accumulation Trusts: Both Primary and Residual Beneficiaries are generally considered, with some exceptions.

A significant new feature allows trusts that divide into separate sub-trusts upon the account owner’s death to apply RMD rules individually to each beneficiary.

5. Surviving Spouse Options:

Surviving spouses now have a new option to elect to be treated as the deceased employee. However, this comes with some caveats:

– RMDs are calculated based on the surviving spouse’s age, not the deceased spouse’s.

– Beneficiaries of the surviving spouse will not receive “Stretch” treatment after the surviving spouse’s death.

Planning Implications:

- The complexity of these rules increases the value of professional financial advice for retirement and estate planning.

- Careful consideration is needed when naming trusts as beneficiaries of retirement accounts.

- The treatment of Designated Roth accounts may impact decisions on whether to use Roth or traditional accounts in employer plans.

- Surviving spouses have new options to consider, but the benefits of electing to be treated as the deceased employee may be limited in some cases.

These new regulations introduce significant complexity to retirement account planning, particularly for post-death distributions. Account owners and their financial advisors will need to carefully review existing plans and potentially make adjustments to optimize tax efficiency and meet beneficiaries’ planning and wealth transfer needs.

The increasing complexity of these rules underscores the growing importance of professional financial advice in navigating retirement and estate planning. As the regulatory landscape becomes more intricate, the value of knowledgeable advisors who can interpret and apply these rules to individual client situations becomes ever more apparent.